Ajna Monthly Protocol Metrics - June 19 to July 19, 2024

Identifying Protocol Trends: Instances, Wallets, Assets, and Pools

Welcome back to Block Analitica’s Monthly Ajna Protocol Metrics update, covering user behaviour and key trends within the Ajna Protocol. Most data in this post is from June 19 to July 19, with some exceptions, where July 22 & 24 protocol data has been analysed. To read our previous Ajna Monthly Protocol Metrics analysis, click here.

This post is broken down into the following sections:

Ajna Instances Overview: Review trends across all Ajna instances.

Ajna Base Overview: While currently smaller than the Ethereum Mainnet instance, Ajna on Base is showing growth in both Total Value Locked (TVL) and user activity.

Ajna Ethereum Mainnet Deep Dive: At the time of writing, the Ajna Ethereum instance accounts for the vast majority of Ajna usage.

Most data covered in this analysis is sourced from the Ajna Analytics UI. Visit the dashboard to learn more about the Ajna Protocol, track positions in real-time, and assess protocol risks: https://info.ajna.finance/.

Monthly Overview

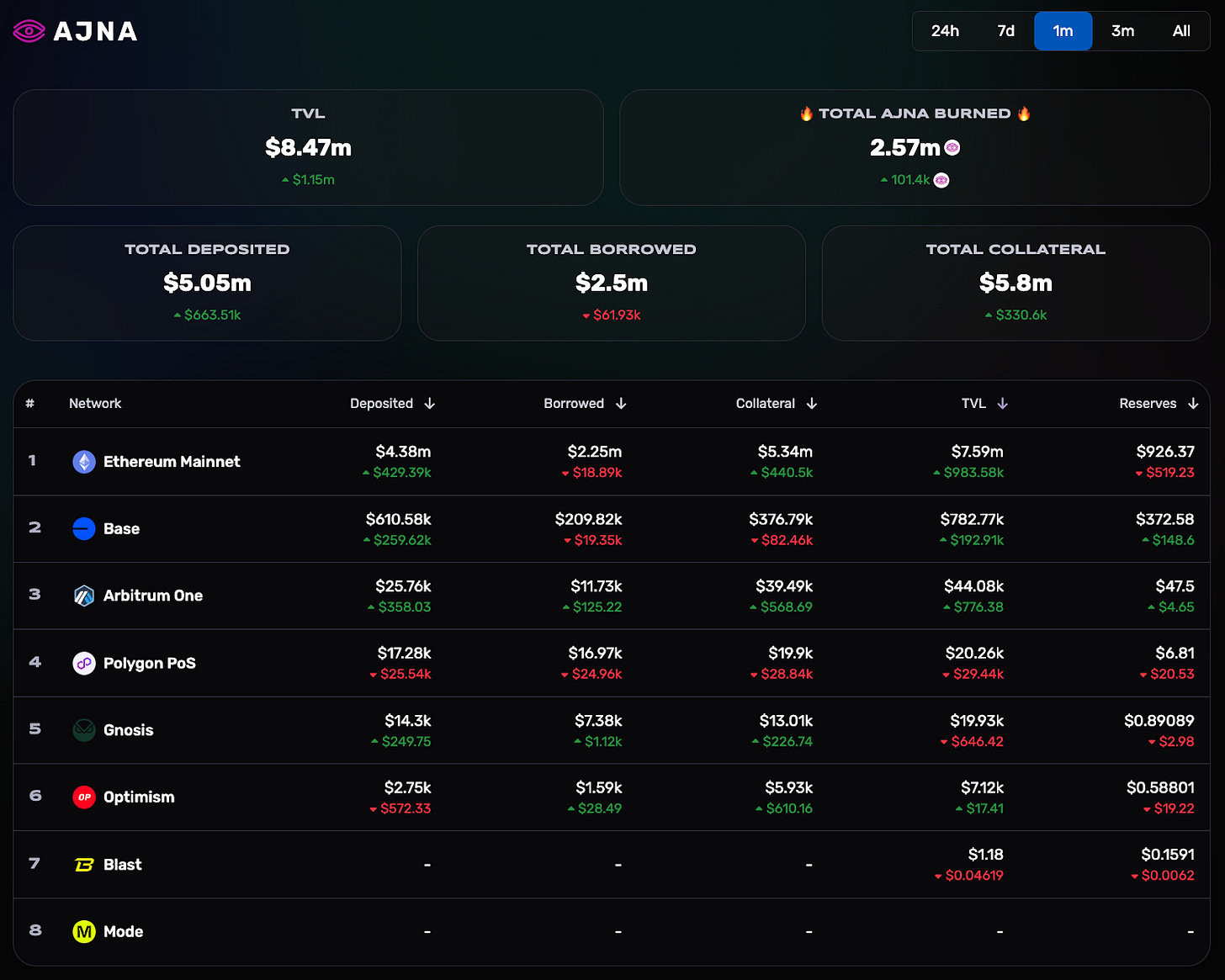

From June 19 to July 19, the dollar-denominated TVL in Ajna increased by $1.15M. This increase is a positive shift following a prolonged period of negative TVL flow. Although Ajna’s TVL is still below its February and March peaks, the TVL decline seems to have stabilised and showing signs of recovery. To learn more about Ajna’s recent challenges, as well as their planned solutions and strategies to help grow the Ajna Protocol, refer to Q1-Q2 State of Ajna in the Ajna Protocol Blog.

Ajna on Ethereum Mainnet is still the largest instance. Measured on July 19, with approximately $7.59M in TVL (~89.6% of total Ajna TVL), $5.05M in deposits, $2.5M borrowed, and $5.8M in collateral value. The AJNA burn was considerably lower this month (~101.4K AJNA) compared to our previous analysis (~687.43K AJNA) which covered data from May, 2024.

Source: Ajna Analytics UI

Reviewing the TVL change over time across all Ajna instances shows that Ajna on Base is maintaining some momentum and usage. The Ajna Base instance is the second largest instance with approximately $782K in TVL (~9.2% of total Ajna TVL). The other instances remain significantly smaller by comparison.

Source: Ajna Analytics UI

Ajna Base Instance

As Ajna on Base appears to be maintaining some usage and relative TVL share, it is worthwhile to examine key protocol metrics more closely. Below, we review key metrics regarding Wallets, Assets, and Pools.

Wallets

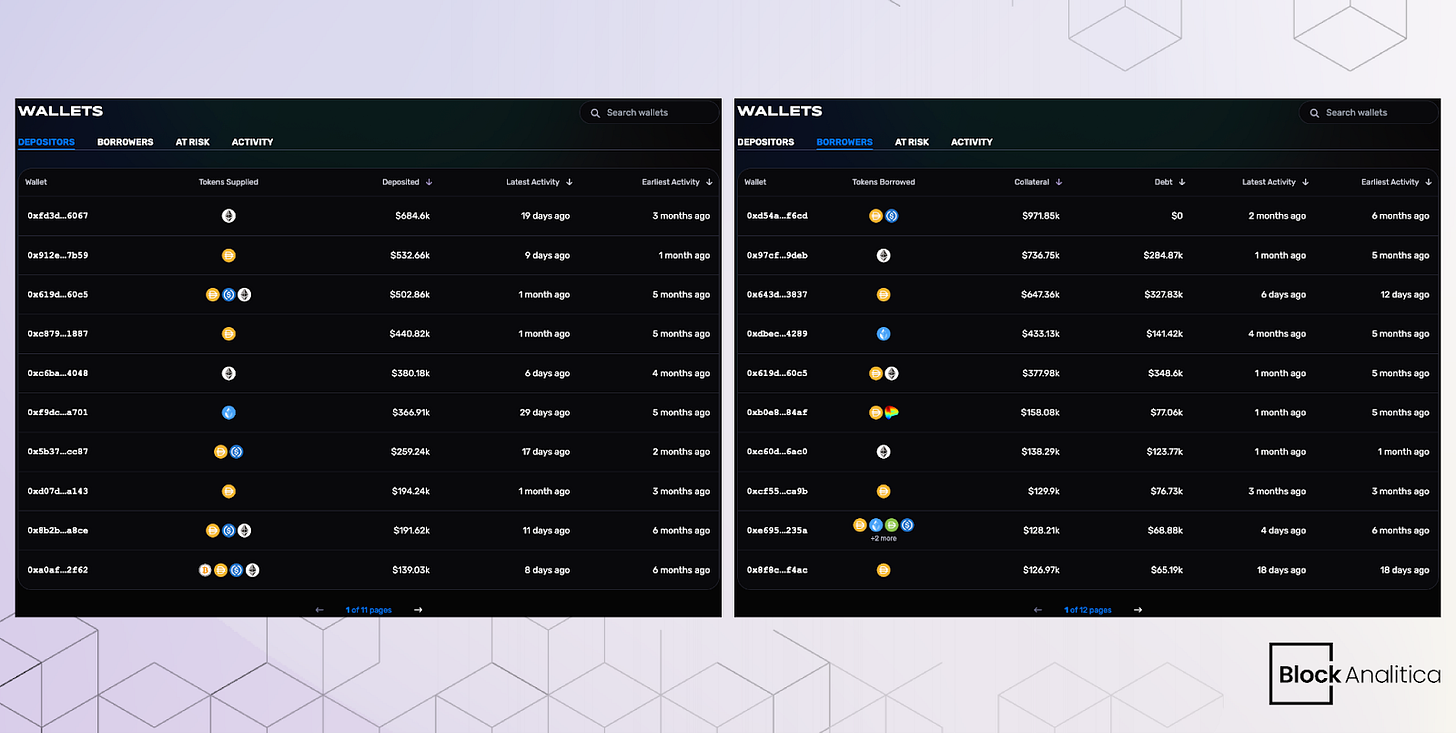

At the time of writing, there are 247 active depositor wallets and 60 active borrower wallets in the Ajna Base instance. However, activity is relatively skewed. Only 23 depositor wallets have over $1K worth of deposits in the protocol. The largest depositor wallet (~$338K), makes up approximately 55% of all deposits.

Source: Ajna Analytics UI Base Instance - Wallets

We notice a similar trend regarding borrower wallets. 20 out of 60 borrower wallets have over $1K worth of collateral in the protocol. 17 wallets have loans that exceed $1K.

Source: Ajna Analytics UI Base Instance - Wallets

Pools

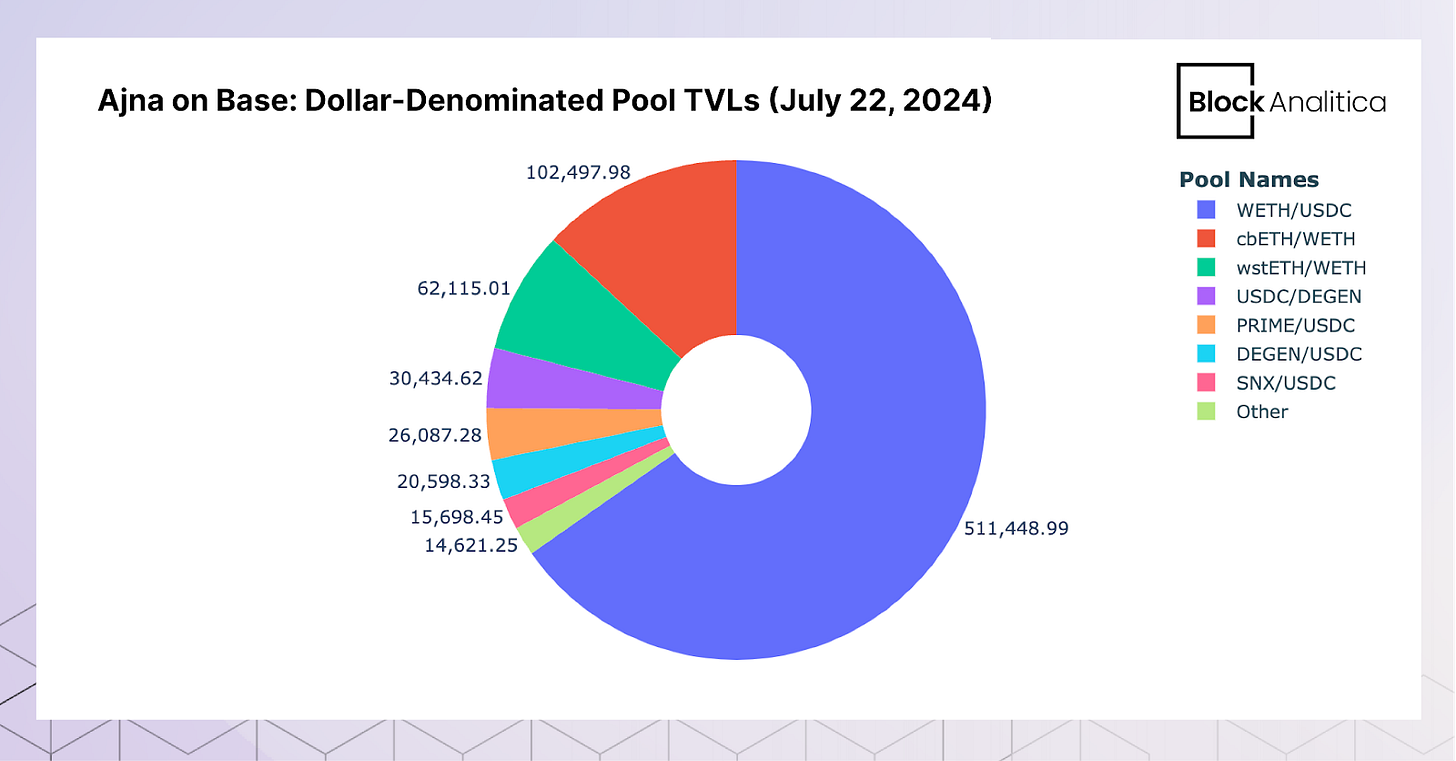

Pool TVLs, much like wallets, are relatively concentrated. At the time of writing, the most popular strategy across the largest depositors is to supply either USDC or WETH. Similarly, for the largest borrowers, they seem to prefer either USDC or WETH for borrowing and collateral. This is reflected in the TVL concentration of the WETH/USDC, cbETH/WETH, and wstETH/WETH pools.

Source: Ajna Analytics UI Base Instance - Pools

Assets

This trend is further illustrated by the chart below, which measures asset TVL and asset pool count. USDC and WETH dominate with the largest TVLs and highest pool count, followed by cbETH and wstETH.

Source: Ajna Analytics UI Base Instance - Tokens

Ajna Ethereum Mainnet Instance

The Ajna Ethereum instance constitutes the vast majority of Ajna usage. For the remainder of this post, we will therefore assess Ajna data on Ethereum Mainnet to identify key protocol trends.

Wallets

On the Ethereum Ajna instance, there are currently 108 active depositor wallets and 111 active borrower wallets. As initially identified in our previous analysis, activity is relatively concentrated among larger wallets.

For example, during the measured period, the 10 largest wallets by deposits represented 78.6% of the instance total. Similarly, the top 10 borrower wallets were responsible for approximately 72% of the total debt. Top depositor and borrower wallets seem to prefer WETH, DAI, USDC, wstETH, and WBTC.

Source: Ajna Analytics UI Ethereum Mainnet Instance - Wallets Depositors & Borrowers (June 19, 2024)

Assets

To gauge recent protocol trends, the chart below shows the TVL change across the 10 assets that experienced the largest TVL appreciation during the measured period of June 19 - July 19, 2024. Interestingly, WBTC experienced the largest TVL increase while only being available in three different pools. By comparison, WETH, the second largest asset by TVL appreciation, is currently available in 34 pools. USDC, the third largest asset by positive TVL change, is available in 40 pools.

Source: Ajna Analytics UI Ethereum Mainnet Instance - Tokens

sUSDe and mwstETH-WPUNKS:40 continue to experience higher TVL volatility, which can be partially explained by the fact that these assets are currently only available in one pool each, where activity is concentrated between a handful of large actors.

Source: Ajna Analytics UI Ethereum Mainnet Instance - Tokens

Pools

Top Pools by TVL Growth

Between June 19 and July 19, the top 5 pools by TVL growth represented approximately 92.4% of all TVL growth from growing pools. The largest gainer was WBTC/DAI, increasing its TVL by ~$576K.

Source: Ajna Analytics UI Ethereum Mainnet Instance - Pools

Migrations

Methodology

Below, we analyse migration flows to Ajna in an attempt to identify where users who are interested in using Ajna source their funds from. This analysis was done using the Ajna Analytics UI by checking “Pool Activity” and “Positions” for each individual pool from the Ajna Ethereum Instance - top Positive TVL Change (30d) chart. By using Etherscan, Arkham, Parsec, and Debank, we then tracked their most recent transaction(s) that appeared associated with the intention to deposit funds into Ajna. We have assessed “Collateral Pledged” amounts for borrowers, and “Add Quote Token” amounts for lenders. We have excluded users who migrated from other positions within Ajna.

It is worth noting that we have only looked at transactions up to seven days prior to depositing funds into Ajna. If a wallet did not migrate their position from another protocol/venue under these assumptions, we categorized the migration source as “Wallet”. It is also worth noting that the migration analysis is used to identify migration patterns. Exact figures are hard to identify because of (i) users migrating with multiple wallets, (ii) users swapping between migrations to change collateral assets, and (iii) the price of tokens at the point of measurement may change over time due the volatile nature of the assets. The migration figures are not representative of change in TVL since (i) other wallets could have withdrawn/added to Ajna, and (ii) asset volatility impacts the dollar-denominated TVL over time.

Analysis

We identified a diverse range of protocols and venues from which assets migrated to Ajna. Most notably was Yearn (strategies) and Binance (withdrawn from Binance to fund positions on Ajna). Other notable migrations were Compound to the WBTC/DAI pool, and Maker to the WETH/USDC pool.

Top Pools by TVL Reduction

During the period of June 19 - July 19, the top 5 pools by TVL reduction represented approximately 96% of all TVL reduction from decreasing pools. This reduction was mostly caused by the mwstETH-WPUNKS:40/wstETH and sUSDe/DAI pools.

Source: Ajna Analytics UI Ethereum Mainnet Instance - Pools

Migrations

Methodology

Below, we analyze migrations from the top 5 negative pools by TVL to understand what users decided to do after exiting their positions at Ajna. Similarly to the migration analysis above, this was done using the Ajna Analytics UI by checking “Remove Quote Token” for lenders and “Collateral Pulled” for borrowers. Users who migrated to other positions in Ajna were excluded from the dataset. It is worth reiterating that we have only looked at transactions up to seven days following a position exit in Ajna. We have only measured one associated activity per migration. If a wallet did not migrate their position to another protocol under these assumptions, we categorized the migration destination as “Wallet”.

Analysis

Only 2 pools experienced considerable migration outflows (mwstETH-WPUNKS:40/wstETH and sUSDe/DAI). The remaining pools (wstETH/WETH, COW/DAI, and PRIME/USDC), while experiencing TVL reductions, did not see any meaningful migrations. One wallet in the wstETH/WETH pool removed ~204 WETH (Quote Token), but soon thereafter redeposited ~200 WETH. The TVL decrease of COW/DAI and PRIME/USDC was very small (~$9K and ~$8.4K respectively), which suggests that the TVL reduction was a product of price volatility.

Wallets that migrated from the mwstETH-WPUNKS:40/wstETH pool deposited their assets either into (i) Thrusted (DEX), (ii) Curve (DEX), (iii) Aave, (iv) Kyber (DEX), or (v) Wallet. The large amount of migrations to DEXs suggests that users swapped their assets to either continue winding down their positions in Ajna, open positions in other Ajna pools, or to deposit somewhere else. Similarly, with the sUSDe/DAI pool, most wallets migrated their assets to either (i) Kyber (DEX), (ii) Wallet, or (iii) Paraswap.