Ajna Monthly Protocol Metrics - May 2024

Identifying Protocol Trends: Instances, Wallets, and Pools

Welcome to Block Analitica’s Ajna Monthly Protocol Metrics update, covering user behavior and key trends of the Ajna Protocol. This post covers protocol data from May, 2024. The post is broken down into the following sections:

Ajna Instances Overview: Reviewing trends across Ajna instances.

Ajna Ethereum Mainnet Pool Deep-dive: At the time of writing, the Ajna Ethereum instance accounts for the vast majority of Ajna usage. We therefore dive deeper into the Ethereum instance to identify protocol trends on the wallet and pool level.

Most data covered in this post is taken from the Ajna Analytics UI. Visit the dashboard to learn more about the Ajna Protocol, track positions in real-time, and assess protocol risks: https://info.ajna.finance/.

Monthly Overview

The Ajna Protocol is deployed on several networks. In order to assess protocol dynamics from all instances, the Ajna Analytics UI homepage presents key metrics from all networks, as well as the option to click through to each individual instance to review more granular data.

Following a period of increased bullishness from February through March, the general market sentiment in April - May was somewhat suppressed. The general bearish outlook was also reflected in Ajna usage. Protocol TVL decreased following a very fast climb to TVL all-time highs in March. Polygon PoS, Arbitrum One, Gnosis, and Optimism, while being relatively small markets, maintained TVL throughout May. The amount of AJNA burned in May was over 687K, or about 28.6% of all AJNA token burned to date.

Source: Ajna Analytics UI

Source: Ajna Analytics UI

Ajna Ethereum Mainnet Instance

At the time of writing, the Ajna Ethereum instance accounts for the vast majority of Ajna usage. For the remainder of this post, we will therefore assess Ajna data on the Ethereum Mainnet to identify protocol trends.

Largest Depositors and Borrowers

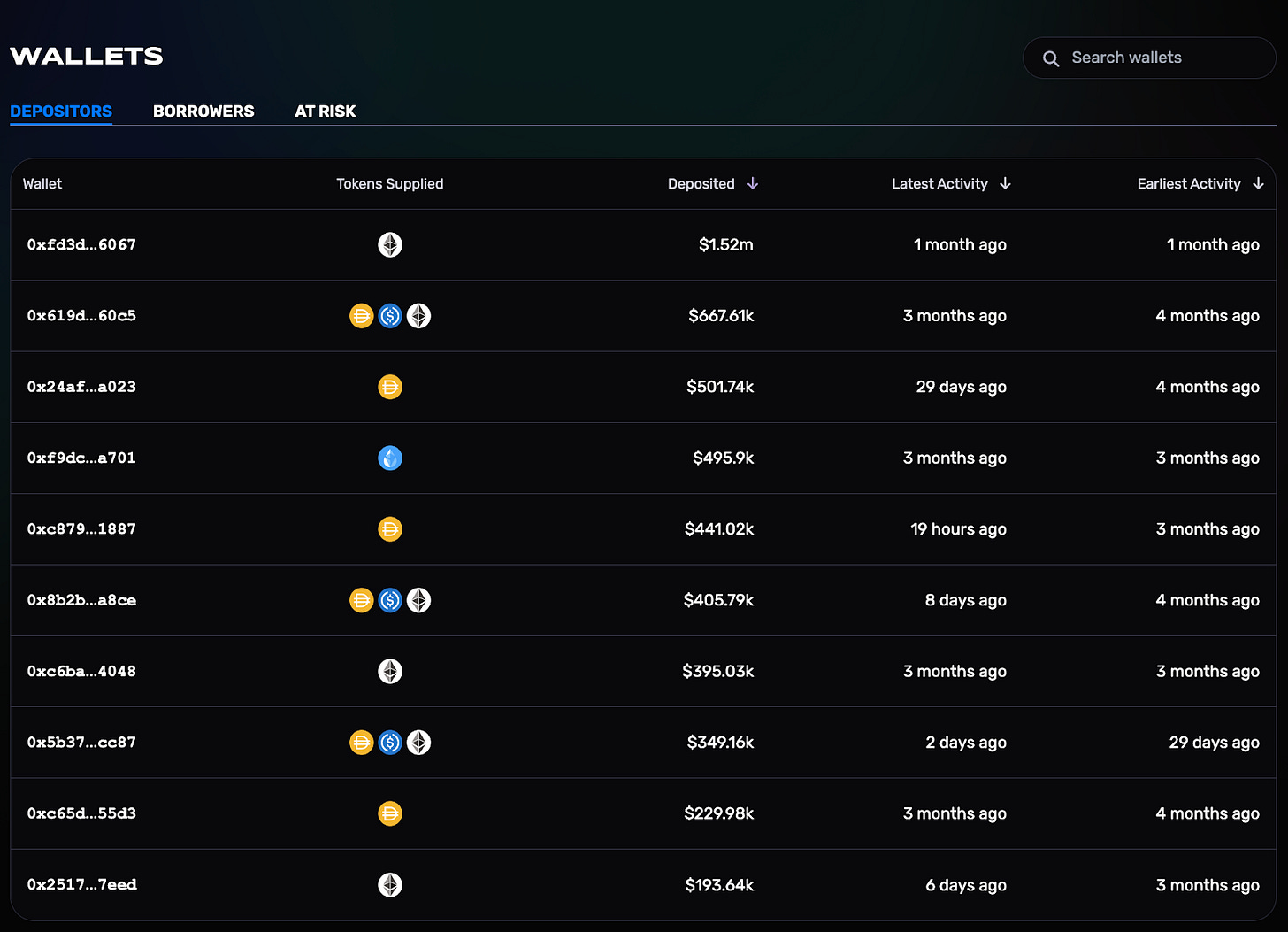

As of May 30, 2024, the top 10 largest depositors represented 77.14% of all deposits on the Ajna Ethereum instance. These depositors prioritize ETH, DAI, USDC, and wstETH. Most of the largest depositors are older users, who first participated in the Ajna protocol 3 - 4 months ago. We notice, however, two new large wallets who started participating in the last 1 - 2 months.

Source: Ajna Analytics UI: Wallets - Depositors

As of May 30, 2024, the top 10 borrowers ordered by debt, represent approximately 80% of total borrowing. Similarly to depositors, these wallets also prioritize large assets such as ETH, DAI, USDC, and wstETH, as well as CRV and sDAI.

Source: Ajna Analytics UI: Wallets - Borrowers

The relatively high concentration of assets is also made apparent when ranking the 45 largest pools by TVL. The long-tailed distribution suggests that Ajna is able to offer popular, larger assets, to larger borrowers, while still enabling smaller, niche borrowers, to permissionlessly create token pair pools. Ajna currently supports 118 pools which have been gradually created over time since inception.

Top Pools by TVL Growth

As of May 30, the top 5 pools by TVL growth represent approximately 90% of all TVL growth from growing pools. The largest gainer is st-yETH/DAI, increasing its TVL by ~$285.37K.

Top Pools by TVL Reduction

On the Ajna Ethereum instance, as of May 30, the top 5 pools by TVL reduction represent approximately 67.5% of all TVL decreases from decreasing pools. These are (i) st-yCRV/DAI, (ii) WSTETH/WETH, (iii) RBN/WETH, (iv) MKR/DAI, and (v) WSTETH/DAI.

Below, we take a closer look at the top 5 negative pools by TVL to understand what users decided to do after exiting their positions at Ajna. This analysis was done using the Ajna Analytics UI by checking “Pool Activity” and “Positions” for each individual pool. We have identified borrowers and lenders who have called either “Remove Quote Token” (lender) or “Repay Debt” and “collateral pulled” (borrower). Thereafter, we have checked if they re-entered into another position in Ajna through the “Events” section of individual wallet pages. Or, if they indeed migrated to another destination by checking on-chain transactions on Etherscan, Arkham, and Parsec.

It is worth noting that we have only looked at transactions up to seven days following a position exit in Ajna. If a wallet did not migrate their position to another protocol under these assumptions, we categorized the migration as “withdrawn to wallet”. It is also worth noting that the migration analysis is used to identify migration patterns. Exact figures are hard to identify because of (i) users migrating with multiple wallets, (ii) users swapping between migrations to change collateral assets, and (iii) the price of tokens at the point of migration may change over time due the volatile nature of the assets. Finally, the migration figures are not representative of change in TVL since users could have redeposited into Ajna, or new users could have deposited into Ajna to offset certain migrations.

Migration Analysis

General Statistics

Over the mentioned pools, the amount of collateral migrated to other protocols is roughly equal to $9.4M. The largest daily withdrawals from the Ajna protocol happened on 16 May ($1.64M), 25 May ($1.36M) and 6 May ($1.27M).

During that period, we can see that 29 unique wallets migrated 65 positions. By looking at their activity, we can see the top three migrated more than $1M each, in total ~$4M. These positions skew the average migration size (~$324k) as the median migration size is ~$145k.

By looking at the analyzed pools, the largest amounts migrated come from the WSTETH/WETH pool ($3.63M, 10 positions), the ST-YCRV/DAI pool ($3.03M, 37 positions), the MKR/DAI pool ($1.17M, 10 positions), the WSTETH/DAI pool ($0.96M, 7 positions), and the RBN/ETH pool ($0.60M, 1 position).

We can see a diverse range of protocols towards which collateral has migrated. These users decided to keep $2.34M worth of assets in their wallets, mostly coming from the ST-YCRV/DAI and MKR/DAI pools. Aave was the destination of $1.39M migrated from the WSTETH/WETH Ajna pool, while Binance saw an inflow of $1.06M from the same pool. The only migration from the RBN/ETH pool went to Aevo, a perpetuals trading platform. Other important protocols to which collateral has migrated are Curve and YearnFi (mostly from the ST-YCRV/DAI pool), Pendle, Balancer and Swell.