We at Block Analitica are excited to announce the launch of the Liquidations page on the Sphere Dashboard! 🔮

→ https://sphere.blockanalitica.com/liquidations

This post provides an overview of Sphere and its new dashboard features.

Sphere Dashboard Overview

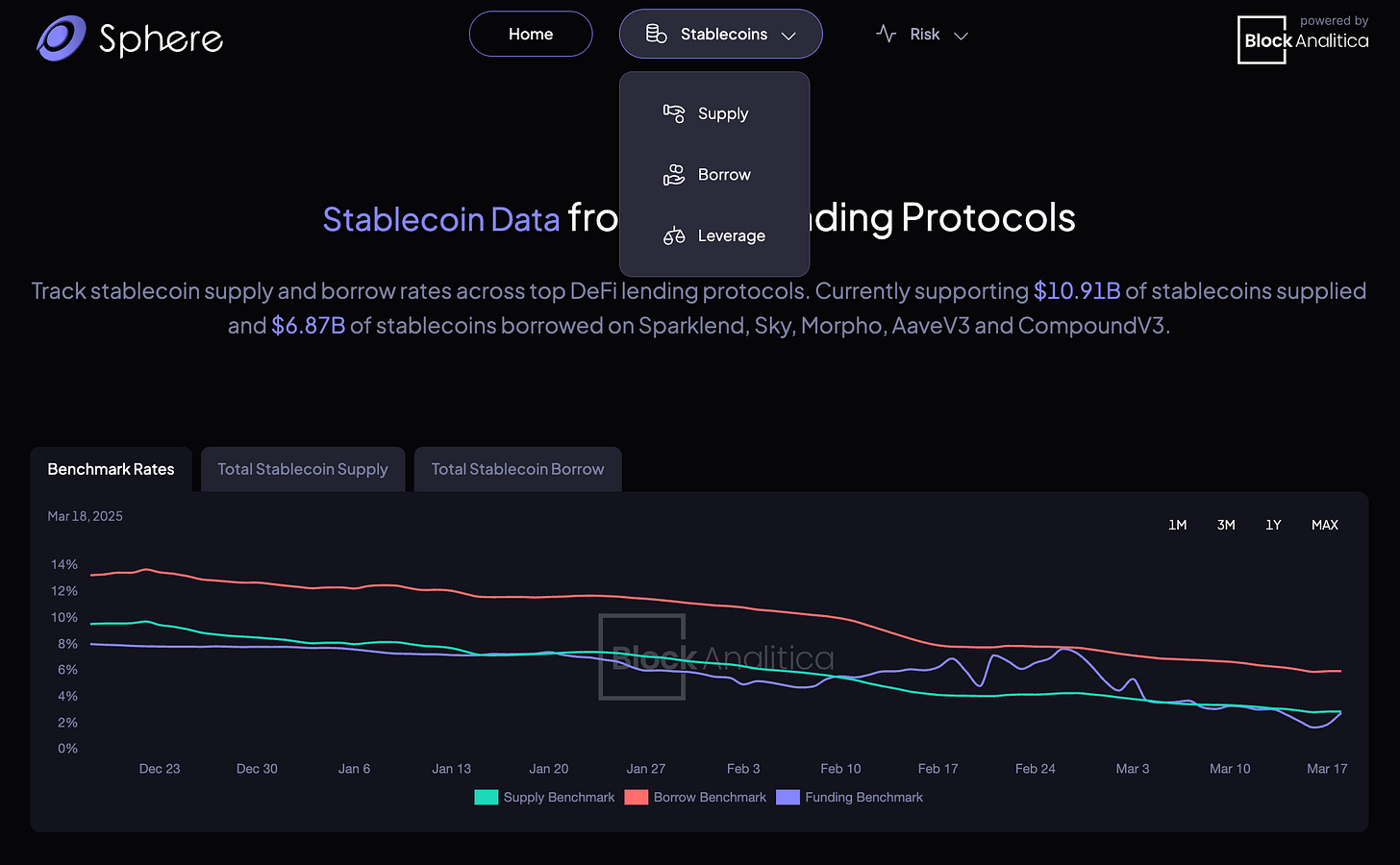

Our goal with Sphere is to provide lenders and borrowers with a one-stop dashboard to quickly and easily access key stablecoin insights in DeFi. With Sphere, users can:

Identify the lowest borrowing and supply rates

Estimate borrow and supply rate impacts

Explore the lowest net APYs

Find the lowest liquidation price (max leverage)

Simulate price impacts from unwinding positions

Compare benchmark rates (supply, borrow, funding)

And from now on, Sphere will also support risk-related data, starting off with liquidations (detailed below).

The Sphere Liquidations Page

The Sphere Liquidations page provides insights into:

Liquidation over time - sorted by collateral

Protocol-specific liquidation data over time

Liquidations categorized by debt assets

Liquidations categorized by collateral assets

Sphere also allows users to choose specific protocols, collateral assets, and debt assets to analyze. Users can track liquidation data across various timeframes: 1 day, 1 week, 1 month, 3 months, 1 year, and max.

Further down the Liquidations page is a “Liquidations” table which provides insights into individual liquidation events, including collateral seized, debt repaid, and liquidation bonus. Using this table, users can, for example, track the largest liquidation events recorded in DeFi or analyze specific liquidation events within a chosen time period.

Sphere currently supports the following protocols (mainnet only):

Aave v3 (Prime & Core instances)

Compound v3

SparkLend

Morpho Blue

Sky (fka Maker)

Note: Fluid support will be added soon.

We appreciate any feedback to improve the Sphere Dashboard. If you have any ideas, feel free to get in touch with us using the contact information below:

Email: info@blockanalitica.com