In collaboration with Sky, we have produced a deep dive into the new SP-BEAM design, its parameter change process, and the ways it can strengthen USDS risk management. This overview was originally posted by Sky on X. You can read the original article here.

Background and Solution

Until now, Sky’s stability parameters could only be updated via Executive Votes held every other week.

In times of volatile market conditions, this delay could result in larger parameter adjustments, potentially risking a negative impact on the user experience for borrowers and savers.

Furthermore, arranging out-of-schedule Executive Votes to change stability parameters more rapidly added significant governance overhead.

With the Stability Parameter Bounded External Access Module (SP‑BEAM), Sky can now adjust stability parameters more efficiently, subject to predetermined safety caps.

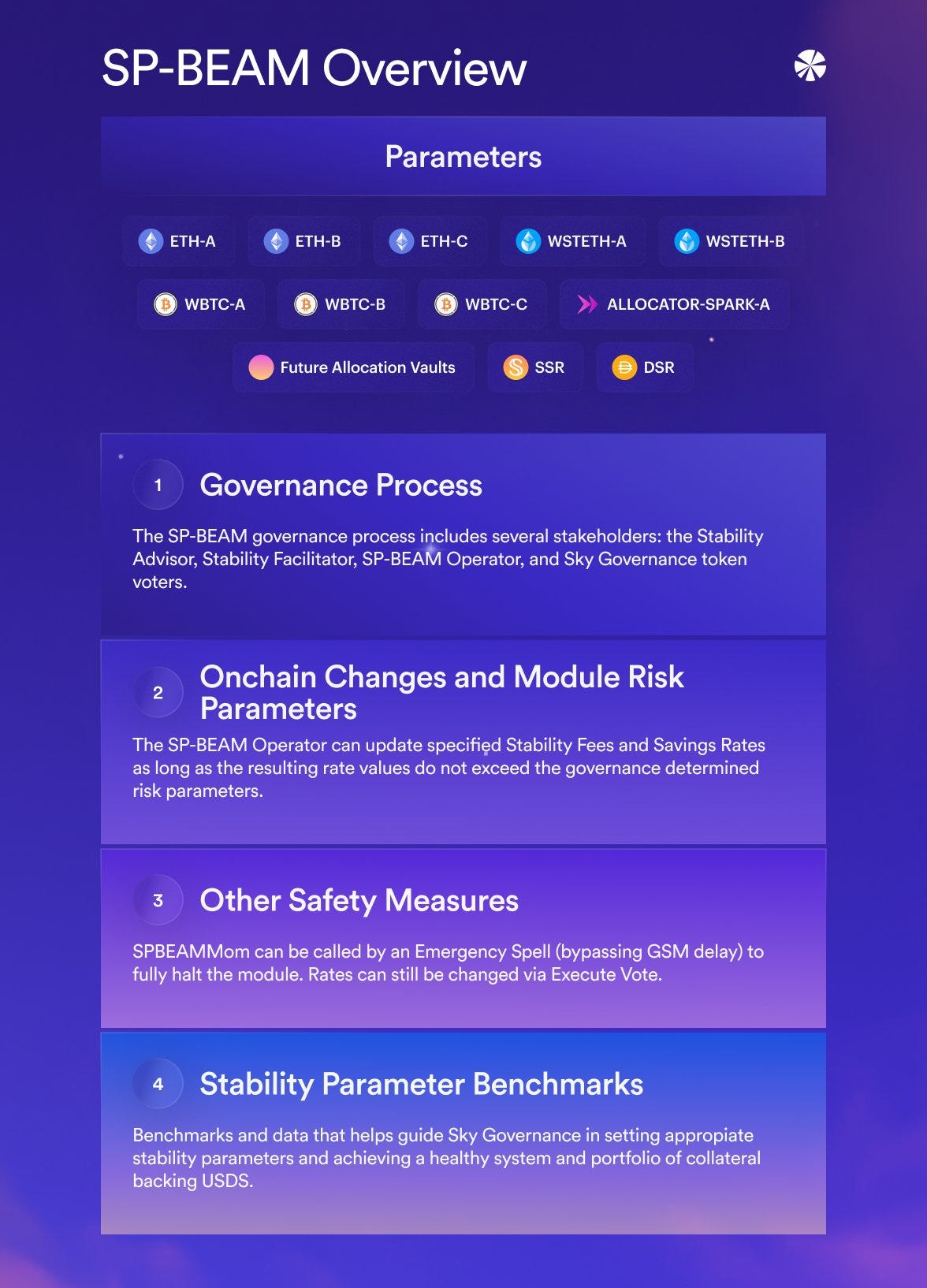

SP-BEAM Overview

Stability parameters are a set of levers used by Sky Governance to keep the Sky Protocol and USDS stablecoin healthy, stable, competitive, and capital efficient.

Sky Governance can use SP-BEAM to adjust the Stability Fees of both Core and Star Allocator Vaults, as well as the Dai Savings Rate (DSR) and Sky Savings Rate (SSR).

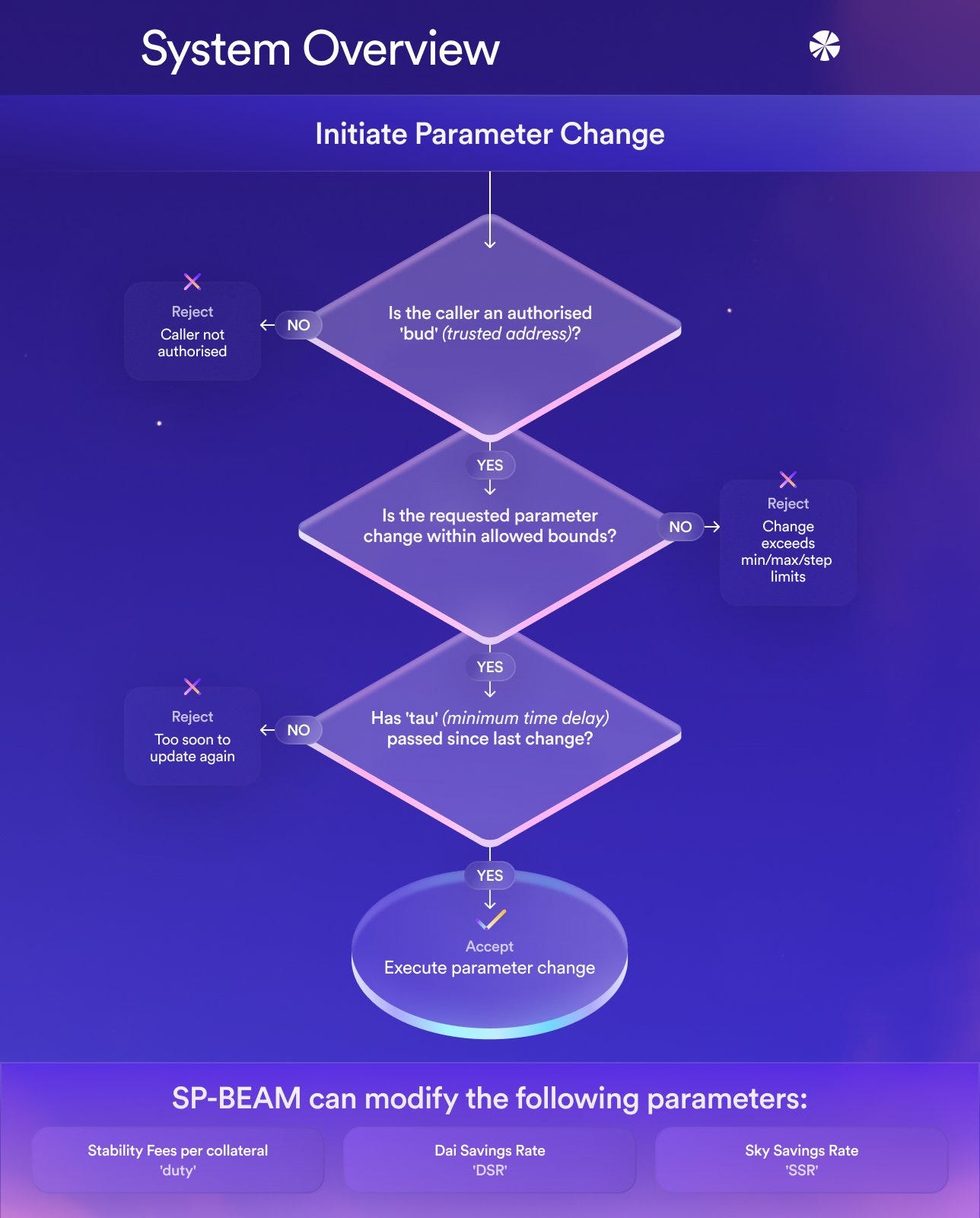

Each step of the parameter change process is outlined in the figure below, and explained in further detail in this article.

1) Governance Process

The SP-BEAM governance process includes several contributors. First, the Stability Advisor proposes a parameter change proposal to the Sky Forum. Thereafter, the Stability Facilitator reviews the proposal. If the Stability Facilitator approves the proposal, a Sky Governance approved SP-BEAM Operator executes the change. Finally, when the change has been made, it is publicly communicated on the Sky Forum.

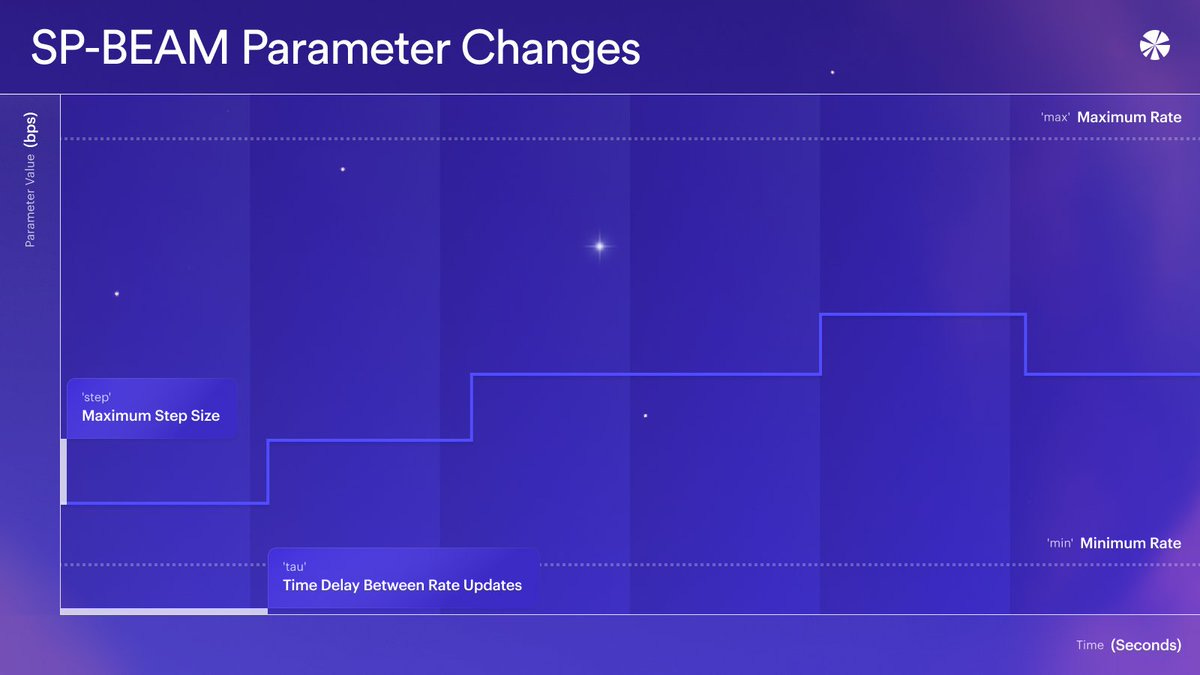

2) Parameter Changes and Module Risk Parameters

Sky Governance specifies a number of SP-BEAM components:

A permissioned SP-BEAM Operator

An absolute maximum rate (max) and minimum rate (min) that can be set by the SP-BEAM Operator

A maximum value per parameter change event (step) and a time delay between rate updates (tau)

The SP-BEAM operator can update specified Stability Fees and Savings Rates as long as the resulting rate values do not exceed the governance determined max/min/step limits and the cooldown period has elapsed.

3) Other Safety Measures

SPBEAMMom: Governance can disable SP-BEAM without the GSM Pause Delay

Change of SP-BEAM Operator: Sky Governance can change SP-BEAM Operator

LineMom: Governance can disable further debt generation of ilks without the GSM Pause Delay

Revert to Executive Votes: Sky Governance can still modify rates via normal Executive Votes

4) Stability Parameter Benchmarks

Sky’s rate system is deliberately kept open‑ended and unconstrained by design. This allows Sky Governance to make continuous improvements without limiting growth or other objectives. There are, however, a number of benchmarks and principles that help guide Sky Governance in setting appropriate stability parameters and maintaining a healthy system.

A) Internal System Health

B) External Market Conditions and Competitive Rates

C) Strategic Goals

These are explained in further detail below.

A) Internal System Health

Tracked via the Sky Risk & Analytics Dashboard: https://info.sky.money/

Peg Stability: A robust reserve of stablecoins is important for maintaining peg stability

Collateral Exposures: Monitor concentration risk and determining appropriate risk compensation

Savings Utilization: Expand USDS supply while controlling expenses

Profitability: Monitor estimates to ensure that parameters remain financially sustainable

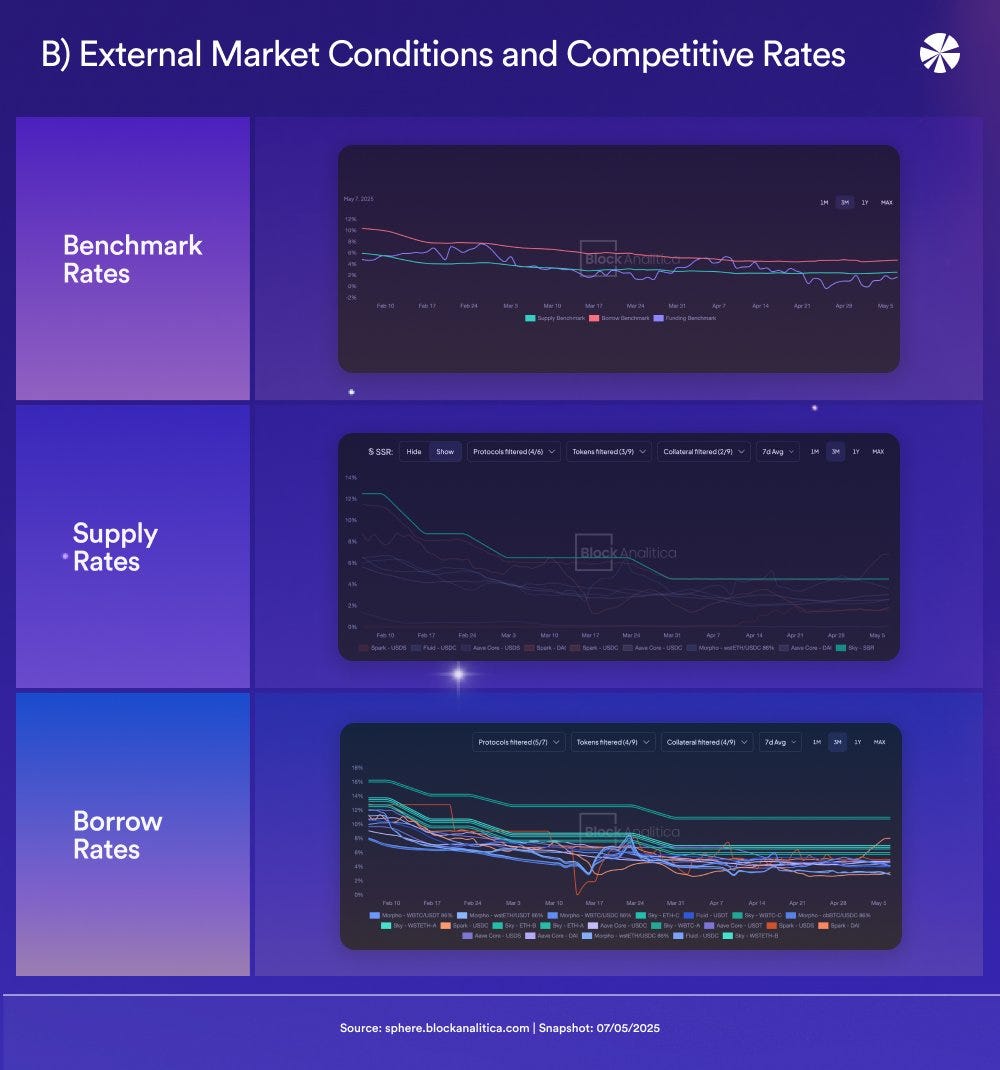

B) External Market Conditions and Competitive Rates

Tracked via the Sphere Dashboard: https://sphere.blockanalitica.com/

Benchmark Rates: Funding rates across major perp exchanges; DeFi benchmarks

Competitive Supply Rates: Where is the SSR in relation to competitors?

Competitive Borrow Rates: How expensive is Sky borrowing in relation to competitors?

C) Strategic Goals

Sky Governance can also adjust stability parameters to meet certain strategic objectives, such as Smart Burn Engine activity, stablecoin growth, or incentivising specific collateral types.

Whatever strategy Sky Governance adopts, SP-BEAM's flexible design ensures that Sky can effectively pursue its strategic goals while rapidly adapting to internal system changes and external market conditions.