Market Overview: December 2024 - January 2025

Recent Trends in Legacy Finance, Decentralized Finance, and the Sky Ecosystem

This report was initially posted on the Sky Forum as part of BA Labs’ monthly market updates. The initiative aims to keep the Sky Community informed and provide additional context regarding our decision-making process, particularly in relation to our parameter proposals for Sky and Spark. You can view the original post here.

Disclaimer

The data and information presented here are for informational purposes only and are provided “as is” without any warranty. This report is not intended or offered as financial, legal, regulatory, tax, or investment advice. References to particular assets or protocols are not recommendations or solicitations to engage with said asset or protocol. MKR/SKY voters and MakerDAO/Sky Ecosystem governance retain full control over parameter changes and are free to use or disregard this information as they see fit. This post does not constitute financial or investment advice. For financial advice, consult a professional advisor.

Introduction

In this market update, we examine recent trends in legacy finance, the cryptoasset landscape, and the Sky Ecosystem, covering developments from December 2024 and January 2025. During this period, we saw a number of important events, including: (i) The Fed pausing rate cuts, (ii) crypto liquidations amid tariff negotiations, and (iii) new all-time highs in stablecoin supply across the cryptoasset ecosystem. Below, we provide a more in-depth analysis of these events, and more.

Note that all market commentary and data is updated as of February 5-8, 2025.

Legacy Finance Conditions

U.S. Economic Reports

Employment: December 2024

After an increase during the first half of 2024, the unemployment rate has remained relatively flat from June through December, fluctuating between 4.1% and 4.2%. In January, it declined to 4.0%, the lowest level since last May.

CPI: December 2024

In December of last year, the all-items index rose by 2.9% YoY, up from 2.7% YoY in November. The index for all items less food and energy, on the other hand, was reported at 3.2% YoY, down from 3.3% in November.

PCE: December 2024

The PCE experienced a similar upward trend, rising 2.6% year-over-year in December, compared to 2.4% in November 2024. PCE excluding food and energy rose by 2.8% YoY, changing little from the previous two months.

FOMC Meetings & Target Rate Probabilities

January FOMC Meeting

As noted in our last market update, the consensus expectation that the Fed would pause its rate-cutting cycle in January proved accurate. The committee decided to maintain the target range for the federal funds rate at 4.25% - 4.50%.

When asked about the possibility of future rate cuts, Chair Powell mentioned the committee’s preference to observe further progress on inflation. However, he also clarified that the FOMC does not necessarily need inflation to return fully to its target before considering additional rate cuts. He suggested that the current policy stance remains “meaningfully restrictive” and could be eased before the target inflation rate is reached to support maximum employment and price stability.

Yield Curve

While still higher than the final months of 2024, long-term rates edged lower at the beginning of February compared to those at the start of January. While this might not be significant enough to draw any meaningful conclusions, it is notable given the Trump administration’s increased focus on long-term yields, particularly the 10Y.

Treasury Secretary Bessent, for example, recently addressed this, stating that “The president wants lower rates,” and that “He and I are focused on the 10-year Treasury and what is the yield of that.”. Further, David Sacks, the newly appointed “AI and Crypto Czar,” when voicing strong support for stablecoins in a recent press conference, highlighted their potential to drive increased demand for the U.S. dollar, something which he implied might help decrease long-term rates.

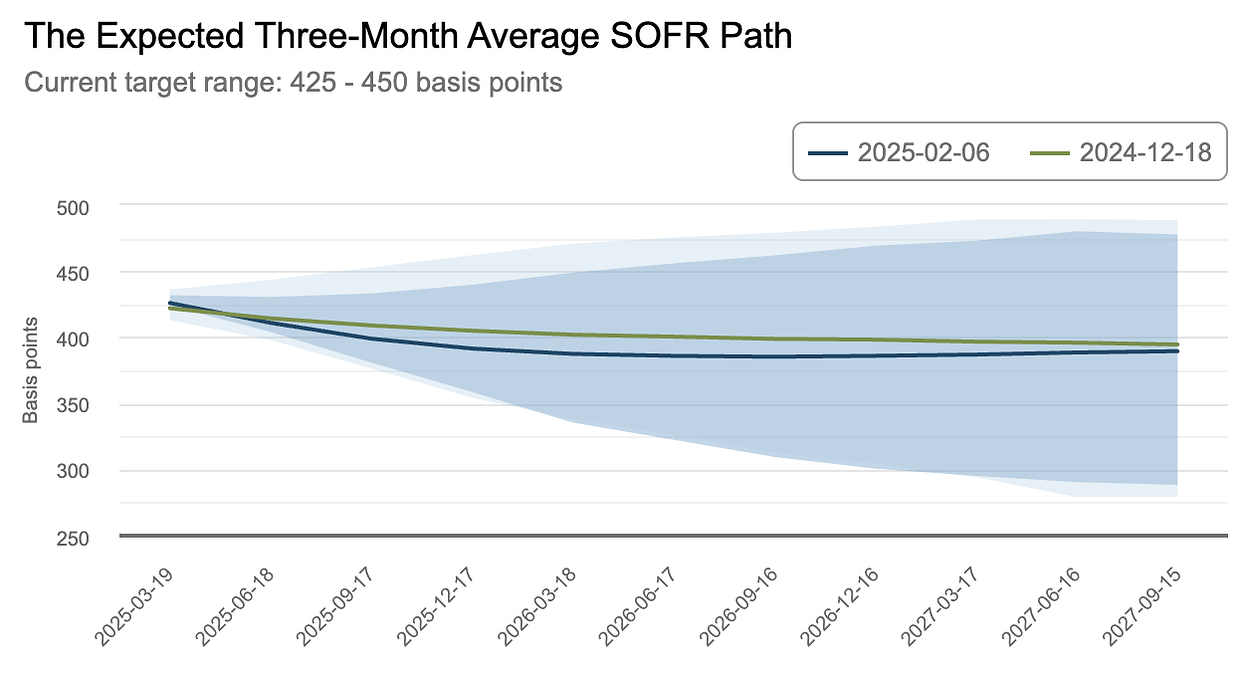

Target Range Probabilities

Market participants continue to anticipate fewer rate cuts in 2025. For the upcoming March meeting, probabilities remain skewed towards maintaining rates above 425 basis points.

Crypto Market Conditions

January Volatility Driven by AI News and Tariff Negotiations

AI News

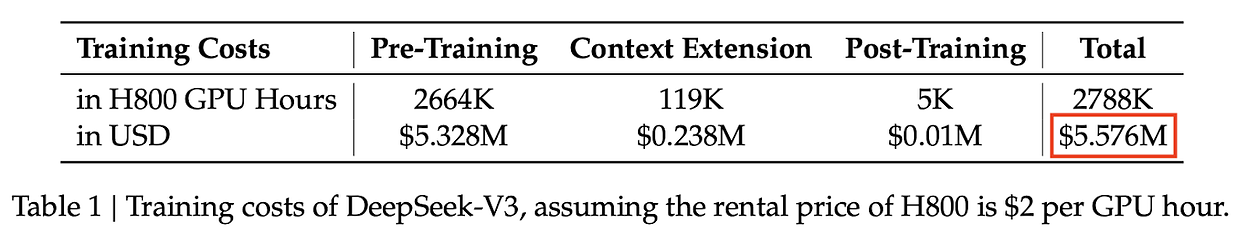

The recent launch of Chinese AI models, including DeepSeek’s V3 (pretrained model) and R1 (reasoning model), spooked the tech sector in January, particularly impacting companies like Nvidia and tech-heavy Nasdaq. The consensus view seemed to be that the volatility stemmed from DeepSeek challenging assumptions of American AI dominance as well as the valuations of U.S. semiconductor and infrastructure companies.

While most volatility came after the announcement of DeepSeek-R1, the breakthrough that actually resonated was the cost reduction achieved by V3 (released in December of last year). V3 is a pretrained model that comes close to the performance of top models from American competitors. According to DeepSeek, by using innovative engineering techniques, V3’s training compute cost significantly less despite using inferior GPUs. DeepSeek also open-sourced its model, which threatens the status quo of OpenAI’s closed-source strategy.

Anthropic CEO, Dario Amodei, argued that the perceived cost differential is likely overstated and that V3 is not a singular breakthrough, but rather an expected milestone on the ongoing cost reduction curve: “DeepSeek produced a model close to the performance of US models 7 - 10 months older, for a good deal less cost (but not anywhere near the ratios people have suggested)”.

Tariff Negotiations & Crypto Liquidations

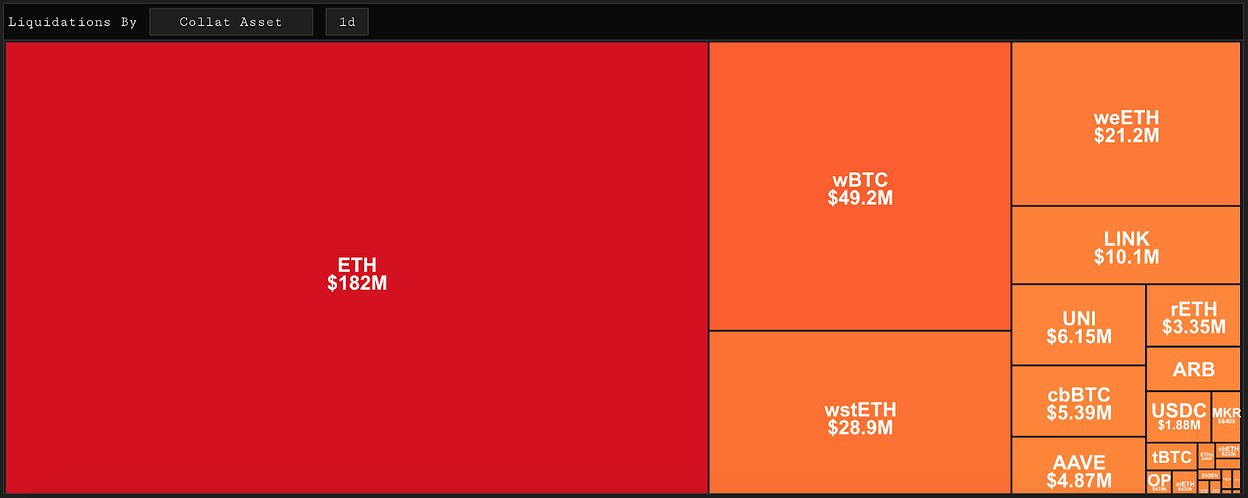

The tariff episode in early February caused significant market volatility. Uncertainty also drove significant volatility in crypto, which, on February 3, led to extensive liquidations across DeFi and centralized exchanges. Ben Zhou from Bybit estimated that approximately $8–10 billion in liquidations occurred over a 24-hour period on February 3, with Bybit alone accounting for over $2.1 billion. In DeFi, liquidations exceeded $313 million on the same day, with the majority taking place on Aave V3 and Compound V3.

Sky and Spark also experienced some liquidations, although the amounts were comparatively much smaller. All liquidations were successfully processed without any bad debt.

Spot ETFs

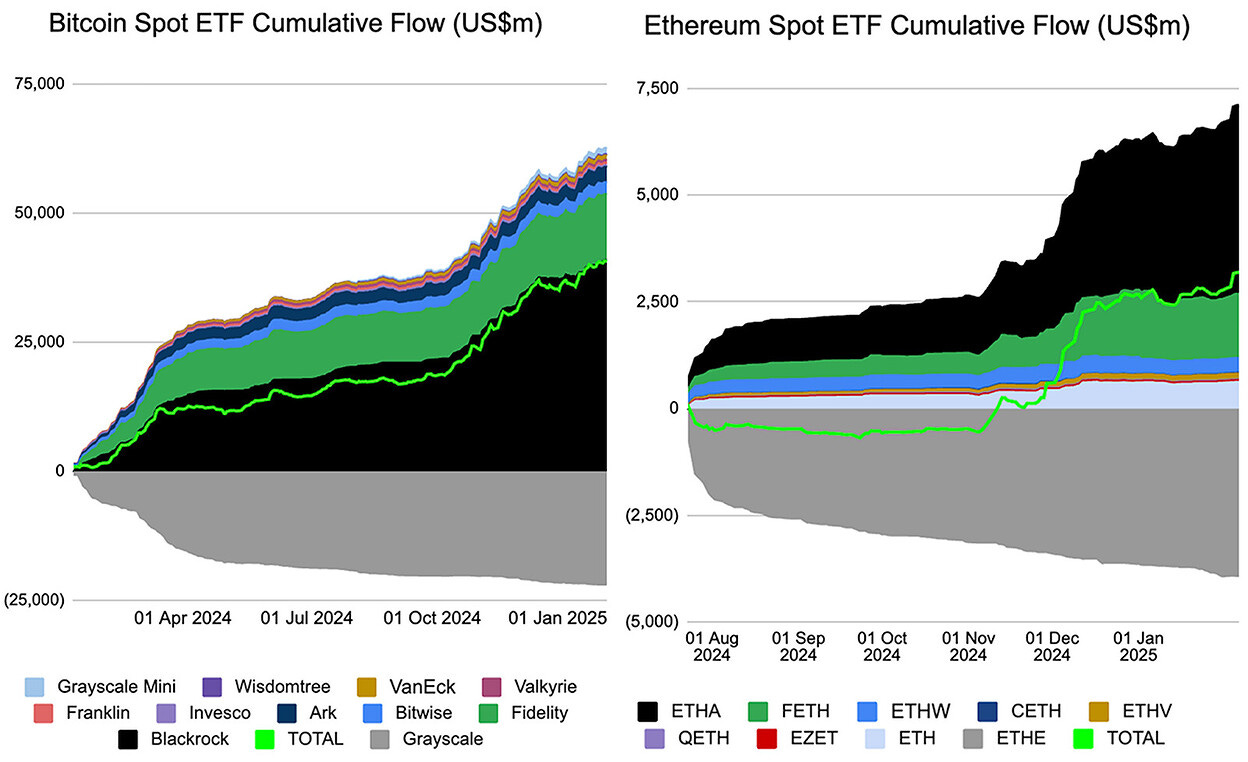

BTC ETFs continue to see consistent growth and demand. Between January 1 - February 6, BTC ETF total cumulative flow increased by $5.29 billion, representing 13% of total cumulative flow since inception.

Following an exceptional December with cumulative flows exceeding $2 billion, ETH ETFs continued to grow between January 1 - February 6 by adding $522 million in cumulative flows. On February 4, one day after the sizable liquidations across DeFi and CEXs, $307.8 million (58% of January total) of flows were recorded.

Benchmark Rates

With the latest update to Sphere, “Benchmark Rates” have been added to the dashboard. The dashboard now includes the “Funding Rate Benchmark” and the “Borrow Benchmark” (formerly referred to as the “DeFi Rate Benchmark”). With dashboard support for DeFi supply data, we have also introduced a new "Supply Benchmark”.

After elevated funding rates in November and the first half of December, the latter half of December and January saw considerably lower rates. At the time of writing, the Funding Benchmark remains at very low levels. Similarly, both the supply and borrow benchmarks have trended down since mid-December.

Stablecoins

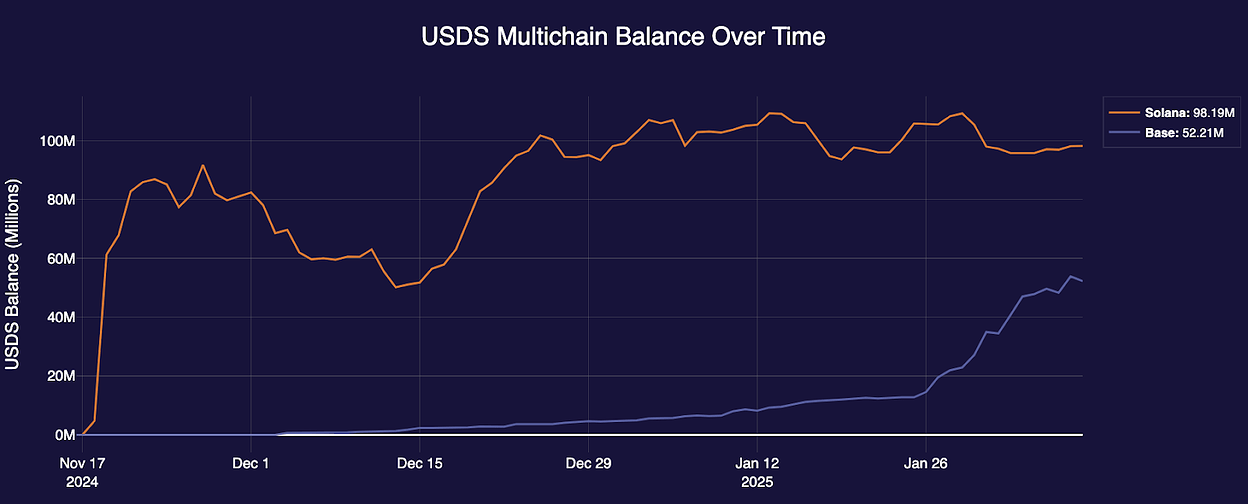

USDS is currently available on Ethereum Mainnet, Base, and Solana. Since the initial surge in supply, USDS on Solana has achieved moderate growth. By comparison, USDS on Base initially had a slower growth trajectory, but has grown significantly in the last two weeks.

Stablecoin market capitalizations are now exceeding previous highs from the last cycle by a wide margin. On February 5, 2025, the total market capitalization across all networks was approximately $220 billion. The previous high of $188 billion was recorded in April, 2022. Ethereum Mainnet, with a market share of around 54%, also recorded a new all-time high of roughly $119 billion on February 5, 2025. Ethereum’s previous all-time high was recorded in February 2022, at around $101 billion.

One of the most notable trends in January was the sudden surge in stablecoin supply on Solana. This was in part due to the release of the TRUMP memecoin, where the primary DEX pair was TRUMP/USDC. As of February 5, total stablecoin market capitalization on Solana has risen to $11.96 billion, up from $4.66 billion in our last update on December 18, 2024. Due to the USDC inflow, USDS share has dropped from 1.3% to 0.8% while maintaining similar supply amounts.

While its growth was less pronounced than that of Solana, Base also experienced an uptick in stablecoin market capitalization, increasing from approximately $3.68 billion on December 18, 2024, to $3.94 billion as of February 5, 2025. As of February 5, USDS accounts for approximately 1.27% of the stablecoin market on Base.

Sky Ecosystem

Collateral Exposures

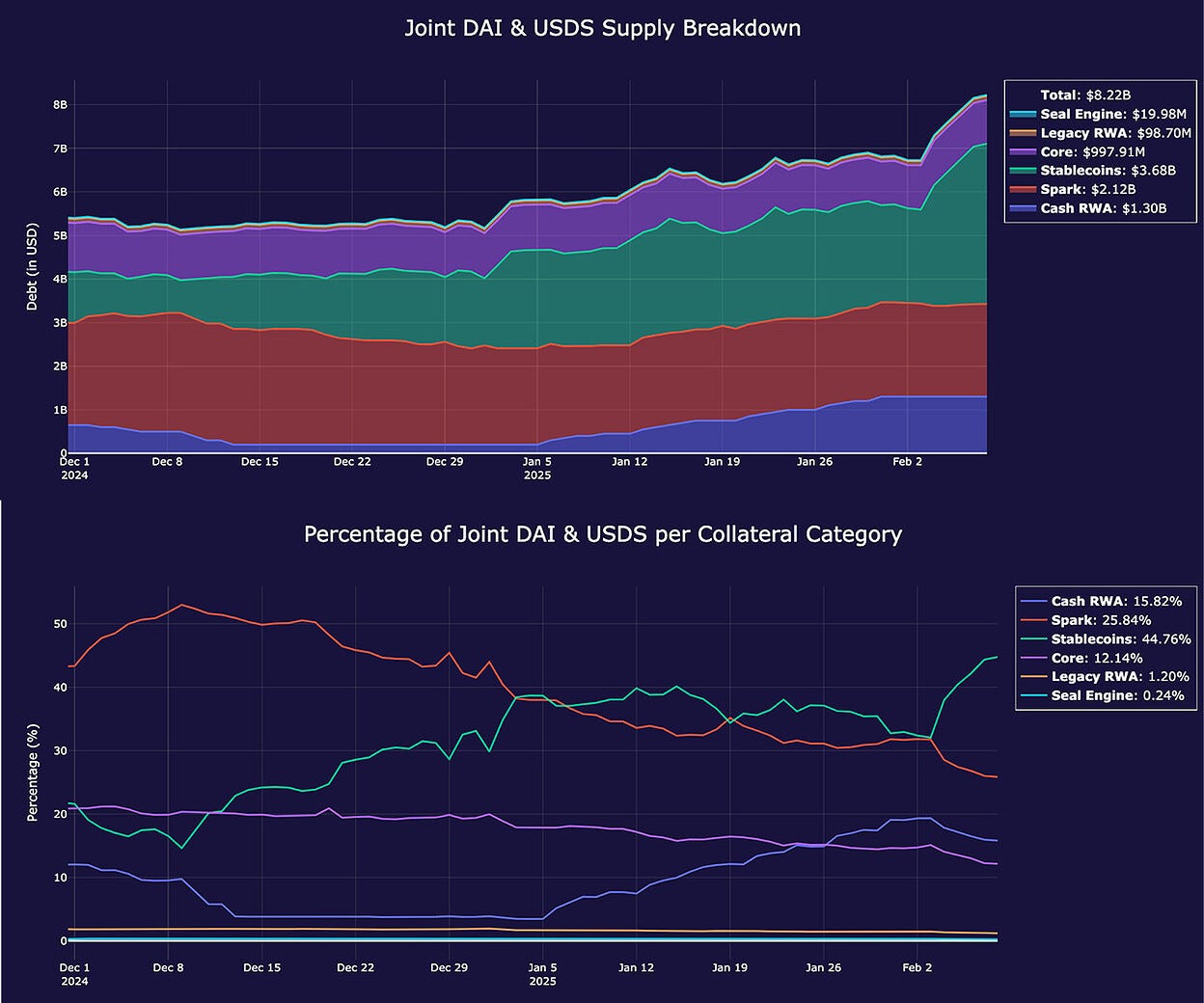

Throughout January, with Sky and Spark rates remaining above average, SparkLend and Core exposures declined. At the same time, Sky accumulated a substantial amount of stablecoin reserves. This trend became even more pronounced in early February. Total USDS+DAI supply is at the time of writing 8.22 billion, up from 5.19 billion in our last update.

Stablecoins & Cash RWA

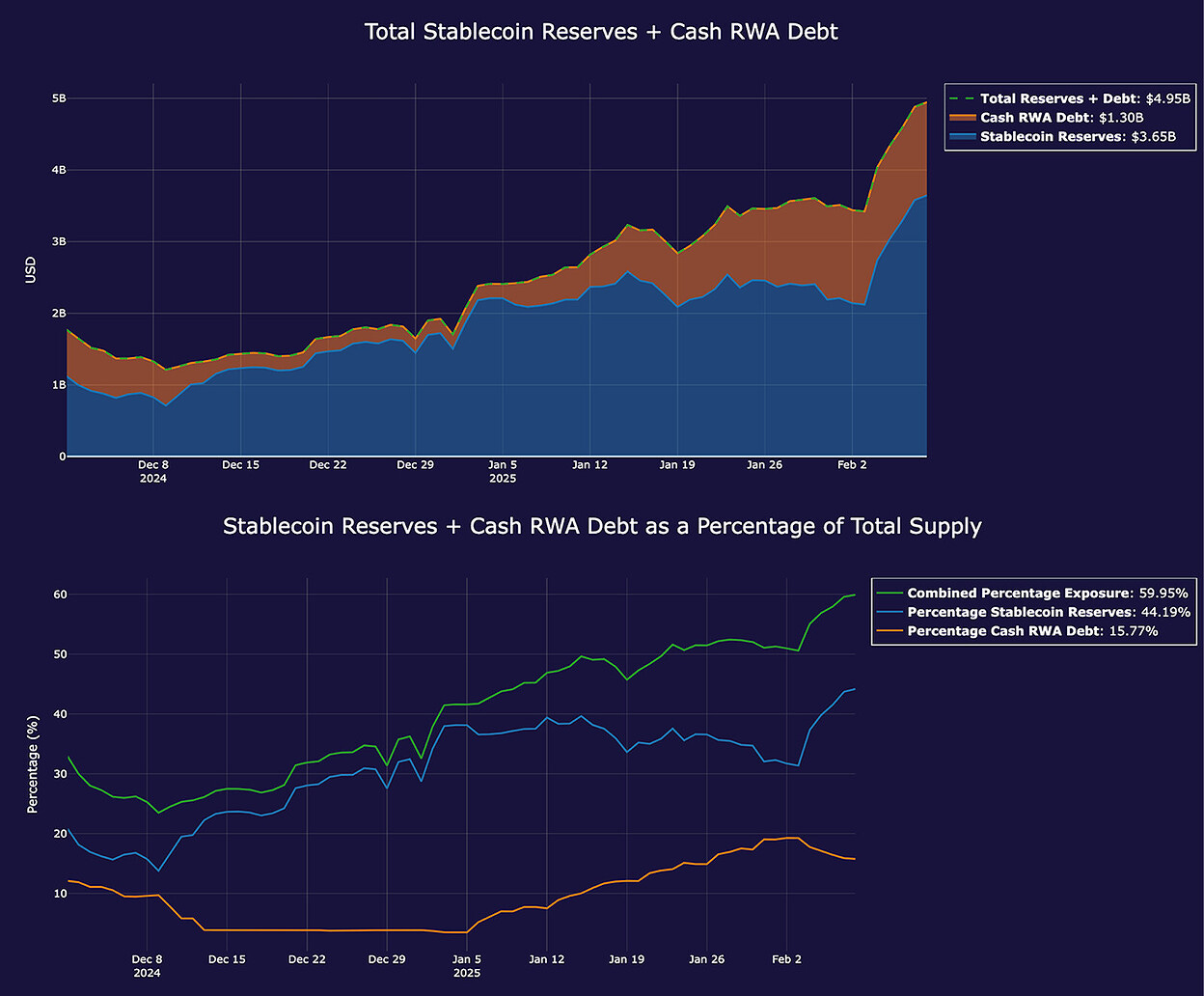

Compared to our previous update, where stablecoin reserves and Cash RWA exposure were relatively low, Sky is now faced with a different situation: combined stablecoin reserves + Cash RWA exposure is exceeding 59% of total USDS+DAI supply.

Spark

Exposure adjustments within the Spark category have been made throughout December and January. The most notable shift is the relative increase in Spark Liquidity Layer exposure, which has reached $407.69 million — accounting for 19.19% of total Spark exposure. Liquidity (USDS, sUSDS, and/or USDC) is now being allocated across Base and Mainnet to PSM3, Aave, Ethena, and the Morpho Spark USDC Vault.

Savings Rates

The rise in stablecoin and Cash RWA backing was in large part driven by users swapping USDC for USDS via the LitePSM to take advantage of the attractive savings rate (sUSDS), particularly in recent days when SSR utilization surged significantly.

Revenue

With the SSR remaining above the market average, savings demand has surged — jumping from $2.79 billion on February 3 to $4.23 billion on February 8. While stability fee revenue has remained at a high level, Sky’s annual net revenue estimate has recently slipped into negative territory. This is not an immediate concern because Sky’s surplus buffer is robust, and a spell that will lower all rates — with the SSR and DSR taking a slightly larger cut relative to borrowing costs — is currently underway.

Reference Parameters

The current Sky parameters are the result of two parameter change proposals from December and January. The first proposal, Stability Scope Parameter Changes #19, where an increase across all Stability parameters was proposed, was executed on December 8, 2024, 21:24 UTC. The second proposal, Stability Scope Parameter Changes #20, focused solely on adjusting the ALLOCATOR-SPARK-A SF and increasing the DSR/SSR spread. It was proposed on January 21, 2025, and executed on January 28, 2025, 14:00 UTC.

On February 3, 2025, BA Labs proposed a new set of parameter changes under Stability Scope Parameter Changes #21, summarized in the table below. These changes have been approved by Sky Governance. However, these changes will not be available for spell execution until Feb 10 2025 14:00 UTC.