Market Overview: April - May 2025

Recent Trends in Legacy Finance, Decentralized Finance, and the Sky Ecosystem

Disclaimer

The data and information presented here are for informational purposes only and are provided “as is” without any warranty. This report is not intended or offered as financial, legal, regulatory, tax, or investment advice. References to particular assets or protocols are not recommendations or solicitations to engage with said asset or protocol. MKR/SKY voters and Sky Governance retain full control over parameter changes and are free to use or disregard this information as they see fit. This post does not constitute financial or investment advice. For financial advice, consult a professional advisor.

Introduction

Our market overviews aim to keep the Sky community informed and to provide context regarding our decision-making process, particularly in relation to our parameter proposals for Sky and Spark. In this market update, we examine recent trends in legacy finance, the cryptoasset landscape, and the Sky Ecosystem from April and May 2025. Note that all market commentary and data is updated as of May 13, 2025.

Legacy Finance Conditions

US Tariffs and Trade Negotiations

In our last market overview from March 27, we flagged April 2 (“Liberation Day”) as the next important date as it relates to US trade policy. The tariff announcement exceeded even the most bearish forecasts, ultimately creating even more market uncertainty than the tariff headlines from February and March. On April 9, the Trump administration decided to pause the “reciprocal” tariffs for 90 days, imposing 10% tariffs on most countries and products, except China. China responded with counter-measures, prompting a tit-for-tat escalation that drove effective tariff rates higher on both sides.

Based on several X posts from Bessent throughout April 23 - 26, the US seems to be negotiating with a number of countries, including: Saudi Arabia, Poland, Turkey, Ukraine, Mexico, Bahrain, Canada, EU, Greece, UAE, Indonesia, Switzerland, Italy, Qatar, South Korea, and Japan. The US also announced their first trade deal with the UK on May 8.

Most recently, the US met with China in Switzerland to negotiate. In summary, the two countries reached an agreement on a 90-day reciprocal tariff pause. During this pause, the US agreed to drop the extra tariffs it imposed on China this year to 30% from 145%, while China is cutting them to 10% from 125%.

The chart below shows that US tariff rates remain exceptionally high despite the 90-day reciprocal tariff pause, ongoing negotiations, the initial trade deal with the UK, and the 90-day pause on China tariffs. At the current pace, the White House is unlikely to finalise agreements with every country affected by the “reciprocal” tariffs before the 90-day pause expires. In any case, judging by the US-UK trade deal, it is likely that tariff rates will at least stay much higher than before Trump took office.

May FOMC Meeting

During the May Fed meeting, the FOMC decided to hold the target range for the federal funds rate steady at 4.25% - 4.50% for a third straight meeting. In their statement they mentioned that the risk of high unemployment and inflation has now risen.

There were no real surprises in the committee’s decision. For example, Rob Kaplan, vice chair at Goldman Sachs and former Dallas Fed president, had said on May 2 that slower growth and sticky prices were likely because of fiscal tightening (public de-leveraging), lower immigration, and tariffs. He argued that the smart thing for the Fed would be to hold rates, wait for clearer data, and try to keep inflation expectations anchored amid tariff uncertainty.

Yield Curve & Target Rate Probabilities

From March through May, we saw a belly-led steepening. Target range probabilities are now skewed towards no change at the June FOMC meeting, which may partly explain why the short end of the curve has remained relatively sticky whilst yields further out the belly have fallen. Compared to the relatively proactive rate cutting cycle last year, some market participants are now speculating that the Fed may wait a bit longer before deciding on further rate cuts.

Amid the tariff uncertainty, the back end of the curve faced pressure as concerns and speculation over basis trade unwinds, foreign selling, and stagflationary impulses pushed yields higher.

Microsoft Quarterly Earnings

In early 2025, tariff uncertainty was not the only source of market unease. As noted in our December 2024 - January 2025 Market Overview, DeepSeek’s V3 and R1 announcements sparked concerns about American AI dominance and the valuations of U.S. semiconductor and infrastructure companies. Satya Nadella, Chairman and CEO of Microsoft, was quick to respond that the increased efficiencies introduced by DeepSeek would lead to demand increasing, not decreasing, referencing Jevons paradox. This assertion was later confirmed by Nadella in the latest Microsoft earnings call. He disclosed that the company had processed over 100 trillion tokens in their latest quarter, up 5x YoY. Including 50 trillion tokens in the final month alone.

Crypto Market Conditions

Stablecoins Taking Center Stage

The last few months have been a pivotal period for stablecoin regulation and adoption. Below, we summarize a number of important stablecoin-related events from April and May worth highlighting.

TBAC Presentation - Digital Money

On April 30, the Treasury Borrowing Advisory Committee (TBAC), an advisory group to the U.S. Treasury, released a presentation on stablecoins referred to as Digital Money. Notably, the presentation was very bullish on stablecoin adoption, projecting the market could reach roughly $2 trillion in market cap by 2028 due to market and regulatory breakthroughs, an almost 8.3x increase from today. Scott Bessent himself reiterated this growth potential on May 7, 2025.

Stripe Stablecoin Financial Accounts and the Bridge USDB Stablecoin

On May 7, Stripe announced Stablecoin Financial Accounts which enables Stripe customers in 101 countries to custody and transfer funds with both fiat and crypto rails. Stripe Stablecoin Financial Accounts are enabled by Bridge, a company acquired by Stripe last year. As noted in the Stripe docs, Bridge is the stablecoin custodian in the new Stripe Stablecoin Financial Accounts system. Stablecoin balances can be held in either USDC (issued by Circle) or newly announced USDB (issued by Bridge).

USDB is backed one-to-one by the equivalent value of US dollars held in cash and short-duration money market funds at BlackRock. USDB will notably be a closed-loop stablecoin (they also refer to it as an infrastructure stablecoin), not available for public sale. However, one of Bridge’s USDB distribution strategies seems to be yield sharing with USDB developers. For example, in a case study on neobank Dakota, Bridge explains that they are responsible for the issuance and reserve management on stablecoins used on the Dakota platform, but share a portion of deposit earnings with Dakota, which they also suggest can be used to fund customer rewards.

Finally, it is also interesting to share that in the recent Stripe Sessions, John Collison, co-founder of Stripe, compared the payment volume in the first 2 years of existence between Stripe and Bridge. He noted that stablecoins are now showing real utility for real businesses at a growth rate which eclipses anything they have seen before at Stripe, including Stripe itself.

The Coinbase x402 Protocol

Coinbase recently announced x402, an open-source internet native payments protocol. x402 enables a number of important use cases that arguably will solidify the intersection of crypto and AI agents, including: (i) per-per-request LLM endpoints, (ii) paywall for LLM data scraping, (iii) streaming APIs billed by the byte, and (iv) agentic commerce.

Spot ETFs

Since our March 27 update, demand for BTC spot ETFs has picked up steam. In the 30 days leading up to 9 May, cumulative BTC flows rose by $4.91 billion, representing approximately 11.92% of total cumulative flows since inception. ETH spot ETFs have also attracted net buying, but at a much slower rate. Cumulative flows increased by roughly $60 million in the same period, equal to 2.44% of total cumulative flows to date.

The Pectra Ethereum Upgrade

The long-awaited Pectra Ethereum upgrade was successfully executed on May 7, 2025. This upgrade brings with it a number of important improvements to the protocol. Some of the most relevant EIPs to Ethereum UX and scaling are:

EIP-7251 (increase maxeb): Increases the validator cap to 2,048 ETH which in turn allows for compounding staking rewards and fewer validators (less stress on the system).

EIP-7691 (blob throughput increase): doubles blobs target per block from 3 to 6.

EIP-7702 (upgrading EOAs): provides wallets with the ability to improve UX by enabling: (i) batching multiple actions into one atomic transaction, (ii) conditional payments, and (iii) sponsored transactions.

Other EIPs were also included in Pectra. Learn more about the upgrade at pectra.wtf.

Up next is Fusaka, tentatively targeted for execution between Q3 2025 and Q1 2026. As it stands, the Fusaka upgrade will mostly include protocol improvements that help L1 and L2 scaling, such as: (i) PeerDAS, (ii) Blob-Parameter-Only (BPO) forks, and (iii) optimisation work that can help increase the L1 gas limit further.

It is also worth noting that several Ethereum developers and community members have already signaled interest in raising the L1 gas limit again, from 36M to 60M. If momentum builds, the change could arrive faster than the previous increase, from 30M to 36M, earlier this year.

Benchmark Rates

On April 25, the Block Analitica Funding Benchmark dipped into negative territory (-0.37%), but has since increased to approximately 7.85%. By contrast, the Supply and Borrow Benchmarks remain subdued at roughly 2.72% and 4.69%, respectively.

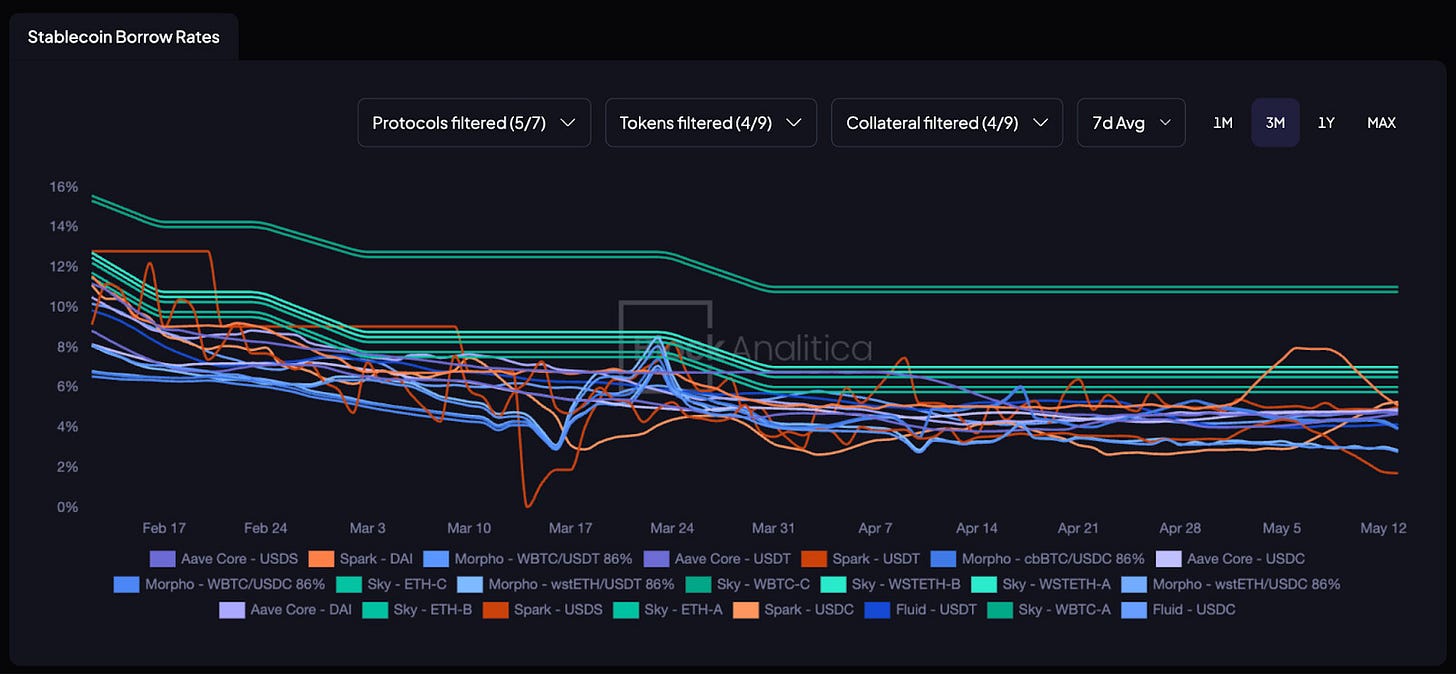

Borrow and Supply Rates

Borrow and Supply rates across DeFi have not changed much since our last update. Sky Core Vaults still have a slight premium whilst the Sky Savings Rate remains competitive.

Sky Ecosystem

Stablecoin Supply

According to DeFiLlama data, global stablecoin supply has grown from $234.616B in our last update, to $242.806B at the time of writing. However, on USDS supported networks, supply has remained relatively flat:

Ethereum Mainnet: $125.78B → $123.745B

Solana: $12.42B → $11.71B

Base: $4.07B → $4.11B

Arbitrum: $3.67B → $2.57B

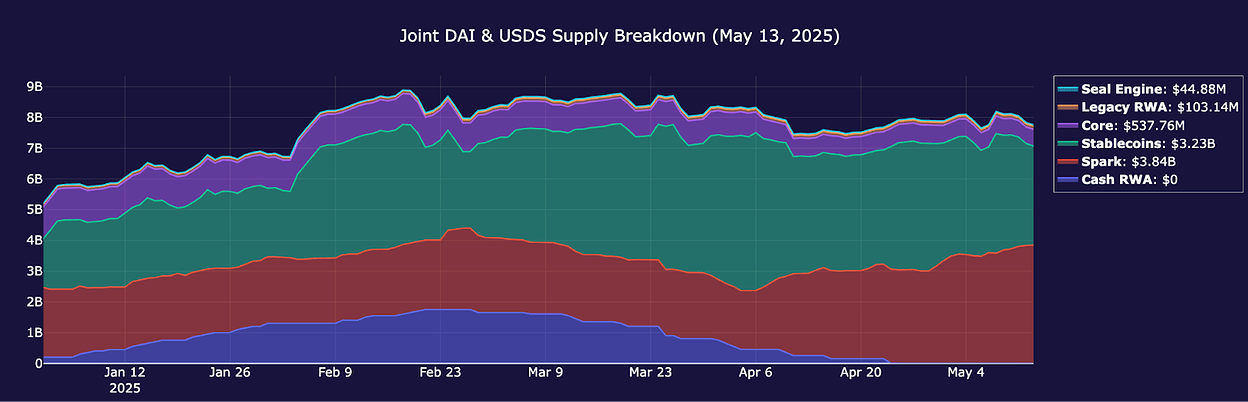

Similarly, USDS and DAI supply on Ethereum Mainnet has stayed relatively flat, currently at a combined 7.02 billion.

Sky has not added USDS support to any new networks since our last update. However, it is worth noting that Phoenix Labs recently proposed to onboard Unichain and OP Mainnet to the Spark Liquidity Layer.

Since our last update, USDS supply on Solana has remained above 100 million, currently at 103.98 million, while USDS supply on Base has dropped off from around 100 million to roughly 52.50 million. USDS supply on Arbitrum, on the other hand, has grown from 13.71 million to 19.82 million. Total USDS multichain supply is now 176.31 million.

Collateral Exposures

Stablecoin reserves have continued to stay elevated, mostly due to the prolonged market downturn and Sky’s attractive sUSDS rate. Core Vault exposure decreased considerably after a series of large liquidations. Finally, given the RWA transition to the Grand Prix winners, BlockTower Andromeda was unwound, and as a result, the Cash RWA category is now $0.

During March and April’s volatility, BA Labs produced two relevant liquidation analyses (1, 2) using the new liquidation page on the Sphere Dashboard.

As it relates to the Sky ecosystem, since our last update, 473 liquidations have taken place, causing $126.13 million in liquidated collateral and $113.36 million in repaid debt. The vast majority of liquidated collateral occurred on Sky Core ($100.37M), of which $88.12 million was WETH.

Spark

In April, Aave Prime USDS and the SparkLend DAI market were added to the Spark Liquidity Layer (SLL). As a result, the process of deprecating the legacy SparkLend DAI direct deposit module (DDM) and the legacy Aave Lido Market (Prime Market) DDM was initiated. Both DDMs are now fully unwound and previous DDM exposure has been consolidated in the SLL.

Furthermore, because BlockTower Andromeda has been fully unwound, RWA exposure has been migrated via the SLL to the Spark Tokenization Grand Prix winners: (i) BlackRock, (ii) Centrifuge, and (iii) Superstate.

BA Labs is developing a new Spark dashboard that will offer more detailed metrics on the Spark Liquidity Layer. Once the dashboard goes live, our market overviews will include more granular data on SLL allocations.

Savings Rates

The Sky Savings Rate has held steady at 4.5% since our last update. It remains competitive due to the persistently low supply rates across DeFi. As per the language of the Atlas, the Dai Savings Rate has been reduced four times in the last three weeks, now at 2.50%. Savings utilization remains historically high. DSR utilization has not yet seen any considerable unwinding despite recent DSR rate reductions.

Revenue

Despite Core Vault unwinding, Sky’s estimated annual USDS profit has held steady since our last update at, now roughly at $81.01 million. This is mostly a result of borrowing costs remaining stable and the reduced DSR cost.

SKY Buybacks

Sky has been buying back tokens steadily since the reactivation of the Smart Burn Engine on February 24, 2025. Total SKY buyback now stands at 797 million (roughly $57.41 million at the time of writing).

Sky’s buyback activity can now be tracked in detail using the newly deployed Treasury page on the Sky Risk & Analytics Dashboard. Learn more in our X thread: Dashboard Update - Sky Treasury Page.

Reference Parameters

Since our last update, the new Stability Parameter Bounded External Access Module (SP‑BEAM) has been deployed. SP-BEAM can be used by Sky Governance to adjust the Stability Fees of both Core and Star Allocator Vaults, as well as the Dai Savings Rate (DSR) and Sky Savings Rate (SSR), without the need of Executive Votes.

So far, the module has been used on four occasions to adjust the DSR and stability fee of ALLOCATOR-SPARK-A. The DSR is being reduced as per language of the Atlas. The stability fee of ALLOCATOR-SPARK-A is being regularly updated in order to reflect the revenue accumulation and phantom revenue from idle sUSDS liquidity in the Spark Liquidity Layer.

The SP-BEAM Configuration forum thread is used for all SP-BEAM communication, including parameter change proposals, approvals, and execution updates.

In collaboration with Sky, we recently produced an article that outlines the SP-BEAM design, its parameter change process, and how it can help enhance the risk management of USDS: Faster, safer governance. SP-BEAM is the answer.