Introduction

We at Block Analitica are excited to announce the launch of Sphere – a new rate explorer and DeFi analytics dashboard! 🔮

→ https://sphere.blockanalitica.com/

Sphere is a neutral, go-to dashboard for borrowers to check relevant lending protocol data. Below, we highlight some of the key features that make the new dashboard an important tool in DeFi, including:

Find the lowest borrowing rates in DeFi ✅

Simulate borrow rate impact (e.g. for borrowing $10M) ✅

Check stablecoin historical borrow rates across DeFi blue-chip protocols ✅

Check additional per-pool parameters (max leverage, LTVs, utilization) ✅

Simulate potential slippage in case of unwinding in one tx [SOON] ⏳

Finding the Lowest Borrowing Rate in DeFi

One of the main objectives with Sphere is to provide an easy way to find the best borrowing rates in DeFi against a chosen collateral asset, all on a single page. In addition, one can check the estimated borrowing rates for the chosen borrowing amount, as well as other info about the chosen pool.

At launch, the dashboard features the following protocols:

Sky

SparkLend

Aave v3 Core and Prime markets

Compound v3

Morpho Blue

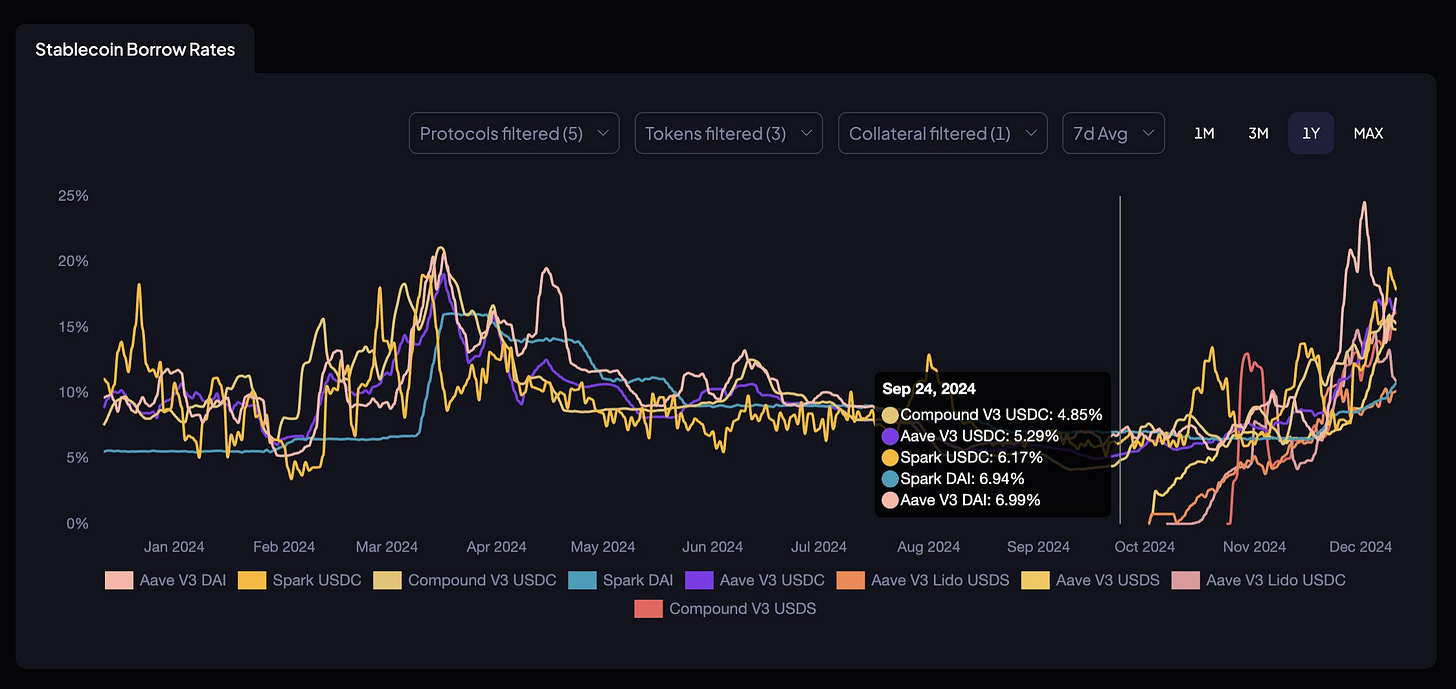

Historical Stablecoin Borrow Rates

The graph shows stablecoin borrow rates for the selected collaterals, with the hover option ordering those from the lowest to the highest ones (7d avg).

Insights:

Find the protocol(s) with historical lowest rates for 1m, 3m, 1y and more

Examine the rate volatility during the selected timeframe

Identify trends and movements of borrowing rates across DeFi

See the current lowest rates on the market

Note: Rates shown are pure borrowing rates, i.e. without taking into account any incentives.

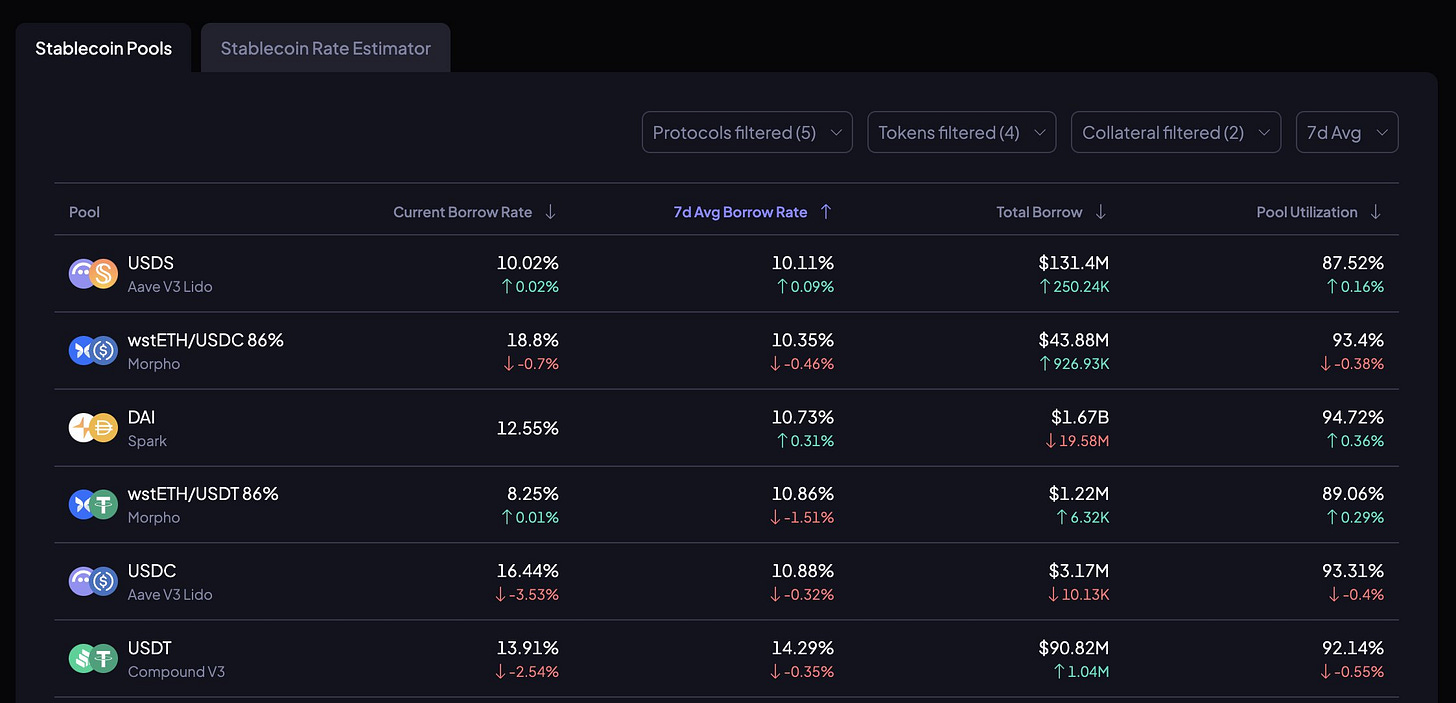

Stablecoin Borrow Rate Pools

The table view is sorted by the lowest 7d average rates by default and offers info on the pool utilization, total borrow, and the current rates.

Insights:

Instant find of the lowest borrowing rate pool(s)

Pools size and utilization, to project the pools' rates volatility profile

Avoiding Unexpected Rate Spikes: Borrow Rate Impact Simulator

For larger borrowers, it's important to estimate rate impact before opening a CDP, as this can prevent scenarios in which there is a significant pool utilization spike, thus affecting the rate and potentially making e.g. looping strategy unprofitable (or simply not acceptable for the borrower).

Large borrowers can utilize the Rate Estimator to cross-check the effective borrowing rates after inputting the desired borrowing amount across all the supported protocols, on a single page.

Insights:

Find the pool(s) with the lowest effective borrow rate based on the borrowed amount

Find out the borrow rate impacts for all the pools

Discover sizable pools that can absorb the incoming borrow amount

Additional Per-Pool Data

After filtering choices down to a couple of favorable pools, checking other per-pool data can help in making a final decision on the desired pool.

Insights:

See max leverage (LTVs) for all supported collaterals

See historical utilization and borrow rate volatility

Slippage Simulator Tool (Estimating Unwinding Costs) - SOON ⏳

Using the (high-upside / high-yielding) but low-liquidity collateral (or simply trading with size) can sometimes imply significant price impacts during deleveraging.

The first thing on our to-do list for Sphere is to release a price impact simulator so borrowers can also have an estimation of leveraging up and unwinding costs, in the form of a slippage distribution curve, before opening the position.

Other Features to Be Added in Future Releases - SOON ⏳

New stablecoins (and collateral assets)

New lending protocols

New networks

Supply rates data

Funding rates: Correlation between DeFi borrowing rates and funding

Let us know if you have any feedback about the existing and upcoming features, we'd be happy to hear any ideas and suggestions!

With all the upcoming features in mind, make sure to bookmark the dashboard for future use!

🔖 🔖 https://sphere.blockanalitica.com/ 🔖 🔖

Disclaimer: The data and information presented in the Sphere Dashboard are for informational purposes only and are provided “as is” without any warranty. The Sphere Dashboard is not intended or offered as financial, legal, regulatory, tax, or investment advice. Any references in the Sphere Dashboard to particular assets or protocols are not recommendations or solicitations to engage with said asset or protocol. The information presented in the Sphere Dashboard does not constitute financial or investment advice. For financial advice, consult a professional advisor.