Exploring the Sky Ecosystem: Core Vaults & Collateral Auctions

An Overview of the Sky Ecosystem and the Sky Risk & Analytics Dashboard

Welcome back to another edition of “Exploring the Sky Ecosystem”. This series has two primary objectives: provide an overview of the Sky Ecosystem while explaining how to navigate the Sky Risk & Analytics Dashboard.

This post provides an overview of Core Vaults and Collateral Auctions, along with a step-by-step guide on how you can review these features yourself.

Core Vaults

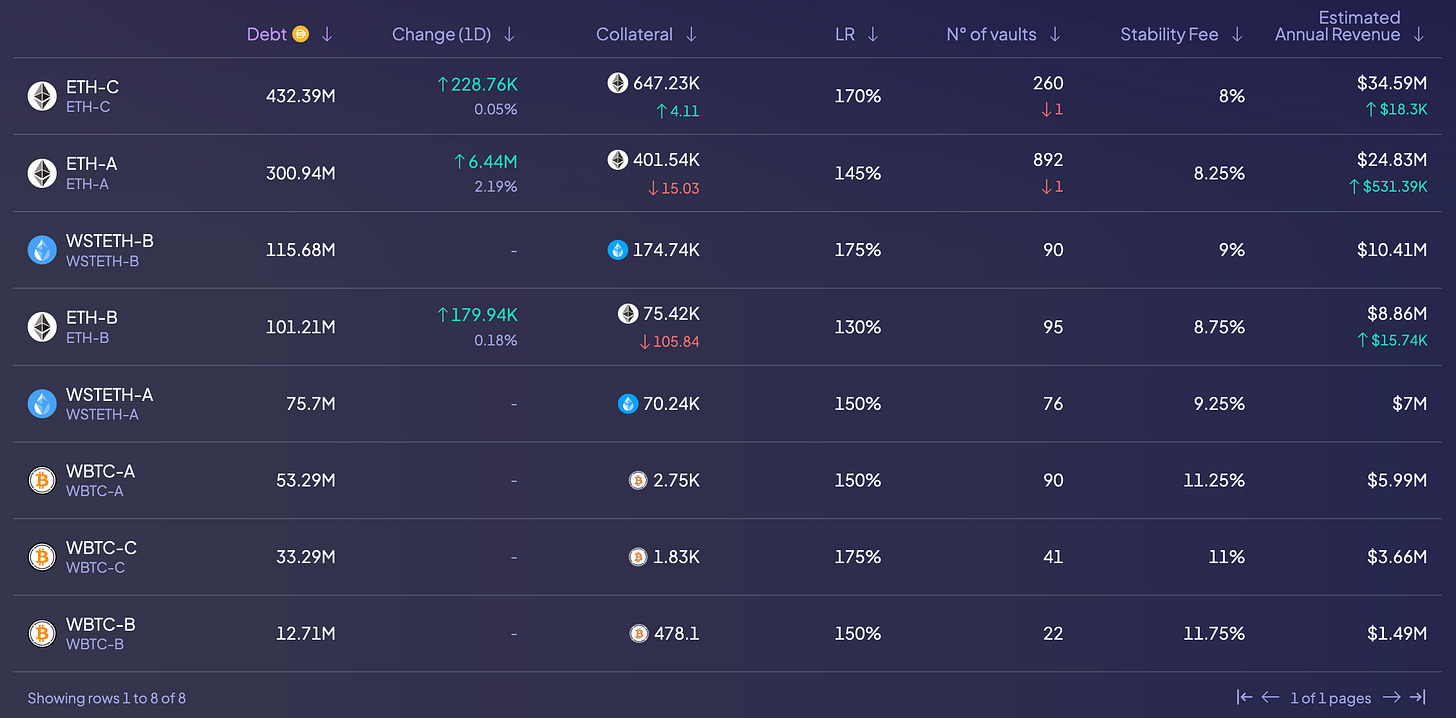

Core Vaults enable anyone to borrow DAI (and optionally upgrade to USDS) against cryptoasset collateral. As illustrated in the screenshot below, Sky currently supports three collateral types—ETH, WSTETH, and WBTC—across eight Core Vault Types.

In this post, we categorise relevant Core Vault data from the Sky Risk & Analytics Dashboard as follows:

Core Overview

Collateral At Risk

Vault Types

Core Vault Parameters

Each category is explained in further detail below.

Core Overview

→ https://info.sky.money/collateral/core

The “Core” page of the Sky Risk & Analytics Dashboard provides a high-level overview of current collateral and debt distributions across Core Vaults. At the time of writing, total debt from Core Vaults amounts to ~1.12 billion DAI, backed by ~$5.38 billion worth of collateral. 74.16% of Core debt is backed by ETH, while WSTETH and WBTC account for 17.01% and 8.82% of Core debt, respectively. Sky's estimated annual revenue from Core Vaults is currently ~$96.82 million.

Collateral At Risk

At the bottom of the Core page, a “Collateral At Risk” chart is included. This chart tracks the collateral at risk at different collateral dropdown levels. The dashboard also features a “Collateral At Risk Historic” chart, illustrating Collateral At Risk at different dropdown levels over time.

Vault Types

→ Example: https://info.sky.money/collateral/core/ETH-A

By selecting a specific Vault Type on the Core page, a more detailed view of that particular Vault Type is provided. For example, as illustrated in the screenshots below, selecting ETH-A displays in-depth metrics for the ETH-A Vault Type.

By pressing the “View All” button next to the “Parameters” section on the ETH-A page, users can view current ETH-A parameters as well as historical parameter changes in further detail.

Similarly, by pressing the “View All” button next to the “Activity” heatmap on the ETH-A page, users can view historical borrow/repay and deposit/withdraw events in further detail.

Core Vault Parameters

→ https://info.sky.money/parameters

The Parameters page provides a comprehensive table of all Core Vault parameters, including (i) debt ceilings, (ii) liquidation ratios, and (iii) stability fees. The dashboard also features a table that provides any new parameter changes as they are implemented by Sky Governance.

Collateral Auctions

If the value of a Core Vault user's collateral falls below the required threshold relative to their DAI debt (known as the Liquidation Ratio), the position is deemed unsafe and may be subject to liquidation. Collateral Auctions serve as a means to recover debt in liquidated Core Vaults.

Below, we categorise relevant Collateral Auction data from the Sky Risk & Analytics Dashboard as follows:

Liquidations Overview

Liquidations By Vault Type

Liquidation Events

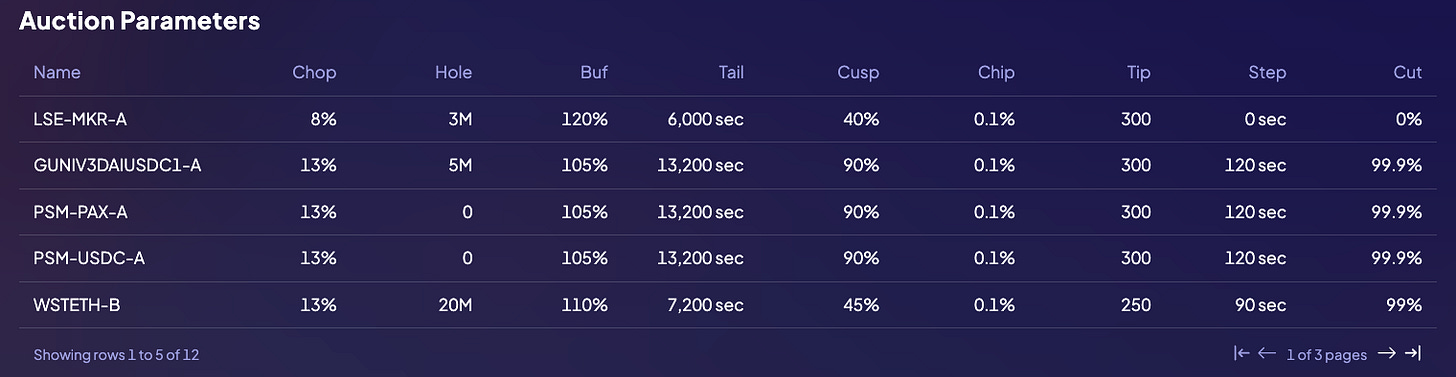

Auction Parameters

Liquidations Overview

→ https://info.sky.money/liquidations

The Liquidations page on the Sky Risk & Analytics Dashboard allows users to view historical liquidation data, categorized by date and by asset. The page also lists all individual liquidation events in a table view, allowing users to click on any specific liquidation event for more in-depth information.

Liquidations By Vault Type

→ Example: https://info.sky.money/liquidations/ETH-A/

The example screenshot below highlights the ETH-A Liquidations page, which displays: (i) the number of liquidations of the ETH-A Vault Type, (ii) the total value of collateral auctioned, (iii) the total amount of debt repaid, and (iv) individual liquidation events over time.

Liquidation Events

→ Example: https://info.sky.money/liquidations/ETH-A/866

By selecting a specific liquidation event in a Vault Type Liquidations table, a more detailed view of that particular liquidation is provided. These pages include insights into (i) sold collateral amounts, (ii) recovered debt amounts, (iii) penalty amounts, (iv) kicks, and (v) takes. The example screenshot below highlights the most recent ETH-A liquidation event, which occurred on September 6, 2024.

Auction Parameters

→ https://info.sky.money/parameters

Finally, it is also worth mentioning that the Parameters page provides a table detailing all auction parameters for each Core Vault Type. These parameters play a critical role in supporting a robust auction system capable of withstanding large liquidation events.