The Spark Data Hub is live!

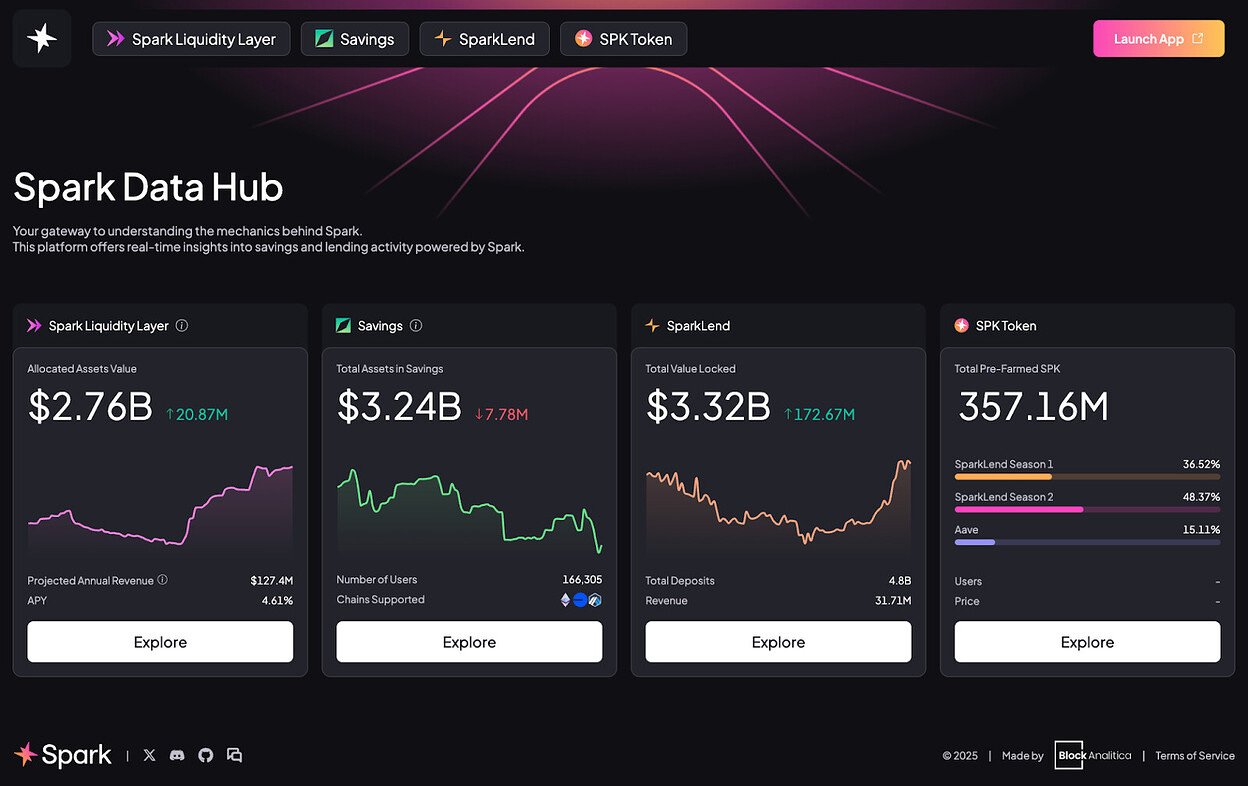

Spark recently announced the Spark Data Hub, a new analytics dashboard built in close collaboration with Block Analitica. In this post we walk through key features and explain how the Spark Data Hub will serve as an important tool across Sky and Spark.

The Spark Data Hub Landing Page

The Spark Data Hub is organised into four main sections, each previewed by widgets on the dashboard landing page:

Spark Liquidity Layer (SLL): The SLL automatically deploys USDS, sUSDS, and USDC from Sky across multiple chains and DeFi protocols, allowing users to earn the Sky Savings Rate on supported networks while enabling Spark to route liquidity where it earns the highest risk-adjusted returns.

Savings: The Savings product allows users to supply supported stablecoins and receive savings tokens in return.

SparkLend: SparkLend is a decentralized, non-custodial liquidity market protocol based on the Aave v3 codebase.

SPK Token: SPK is the upcoming governance token of the Spark Star. The SPK token has not been launched yet. Please beware of scammers and false SPK tokens.

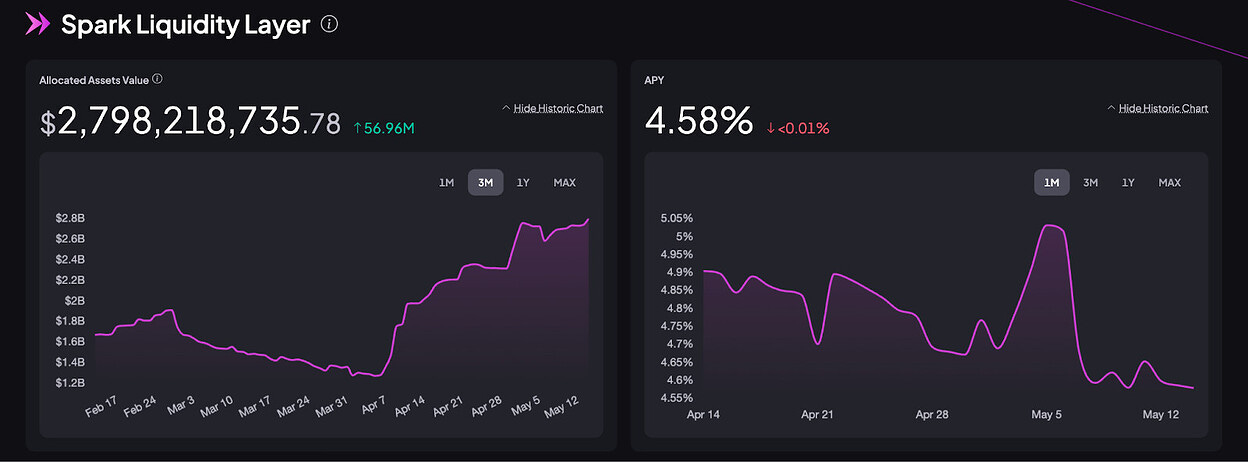

Spark Liquidity Layer Page

Historical View of Allocated Asset Value and SLL APY

At its core, the Spark Liquidity Layer (SLL) automates the deployment of USDS, sUSDS, and USDC from Sky across multiple protocols and networks. This reduces rate volatility, mitigates liquidity fragmentation, and provides users with the best risk-adjusted return on stablecoins in DeFi.

At the top of the Spark Liquidity Layer page in the Spark Data Hub, the two charts provide additional context: one tracks the dollar-denominated value of allocated assets over time (liquidity), and the other plots the historical APY (risk-adjusted return).

Allocated Assets Distribution Breakdown

Arguably one of the most important features of the new Spark Data Hub is its real-time, transparent, and easy to read breakdown of Spark Liquidity Layer allocations. The “Allocated Assets Distribution Breakdown” section lists all current SLL allocations by protocol, network, and asset.

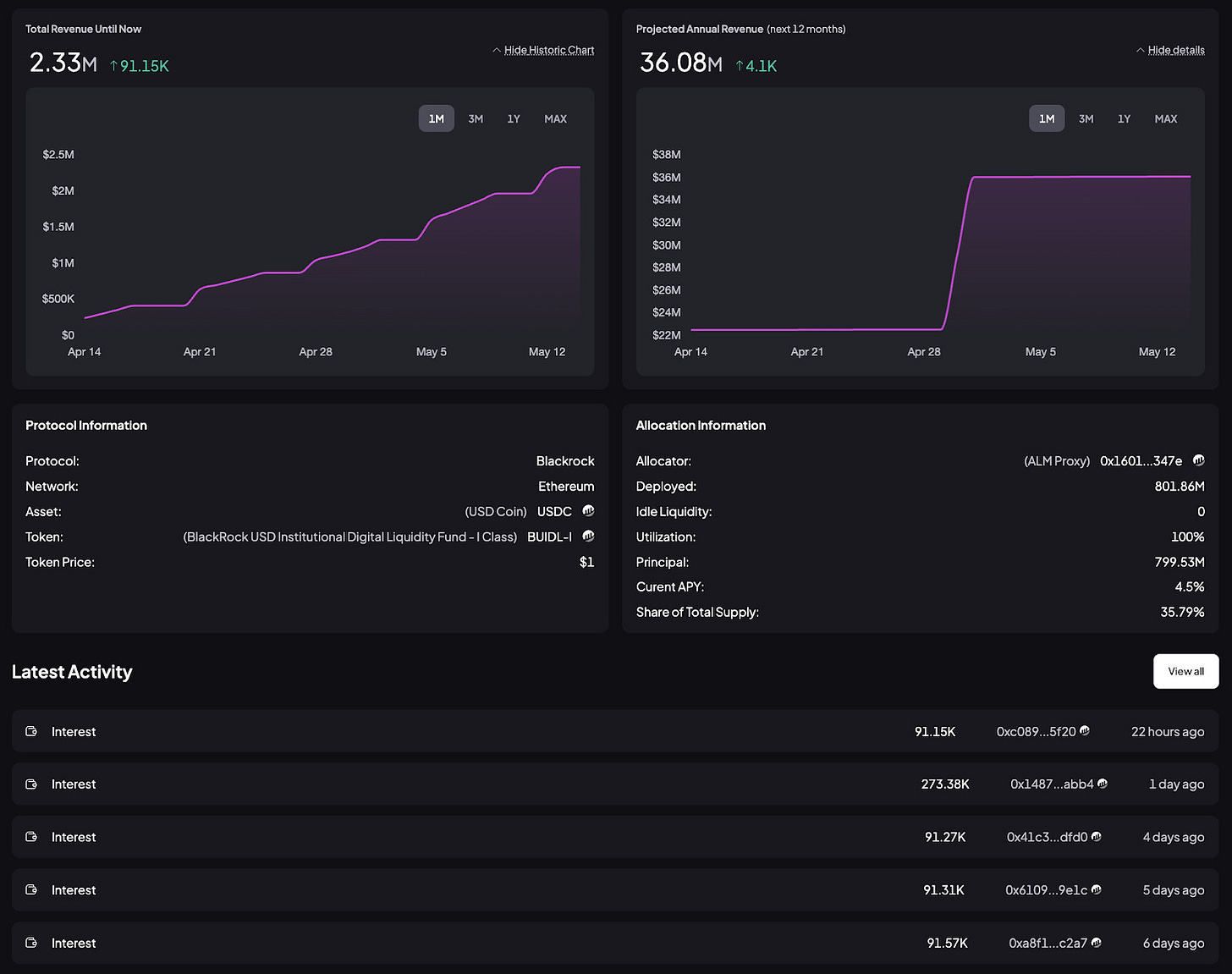

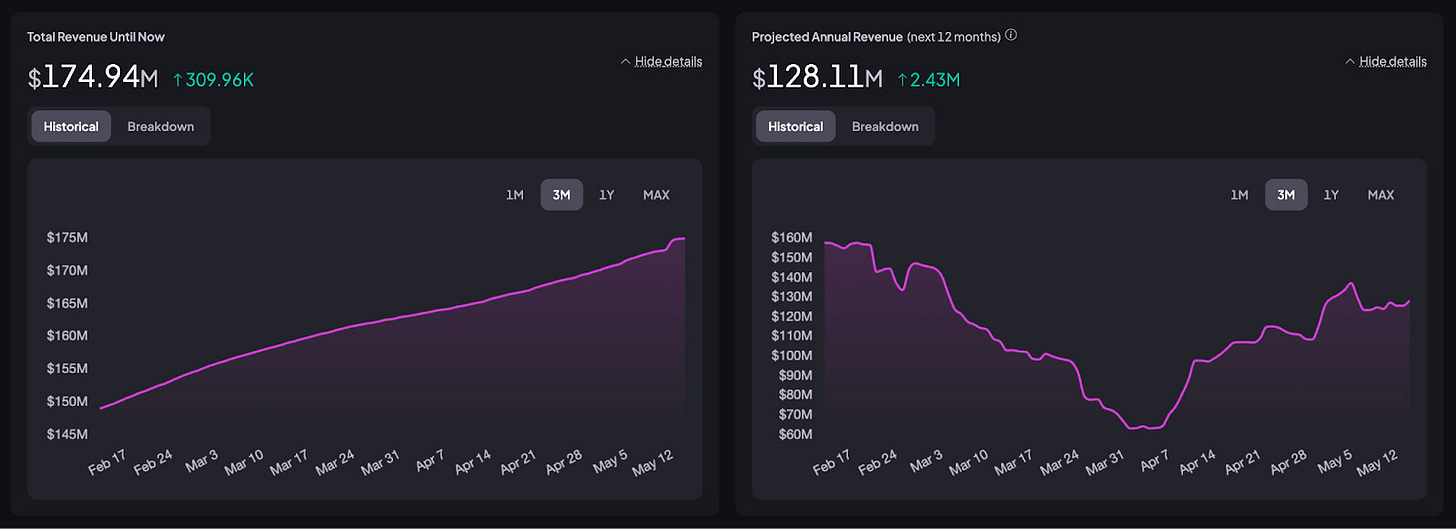

Spark Liquidity Layer Revenue Metrics

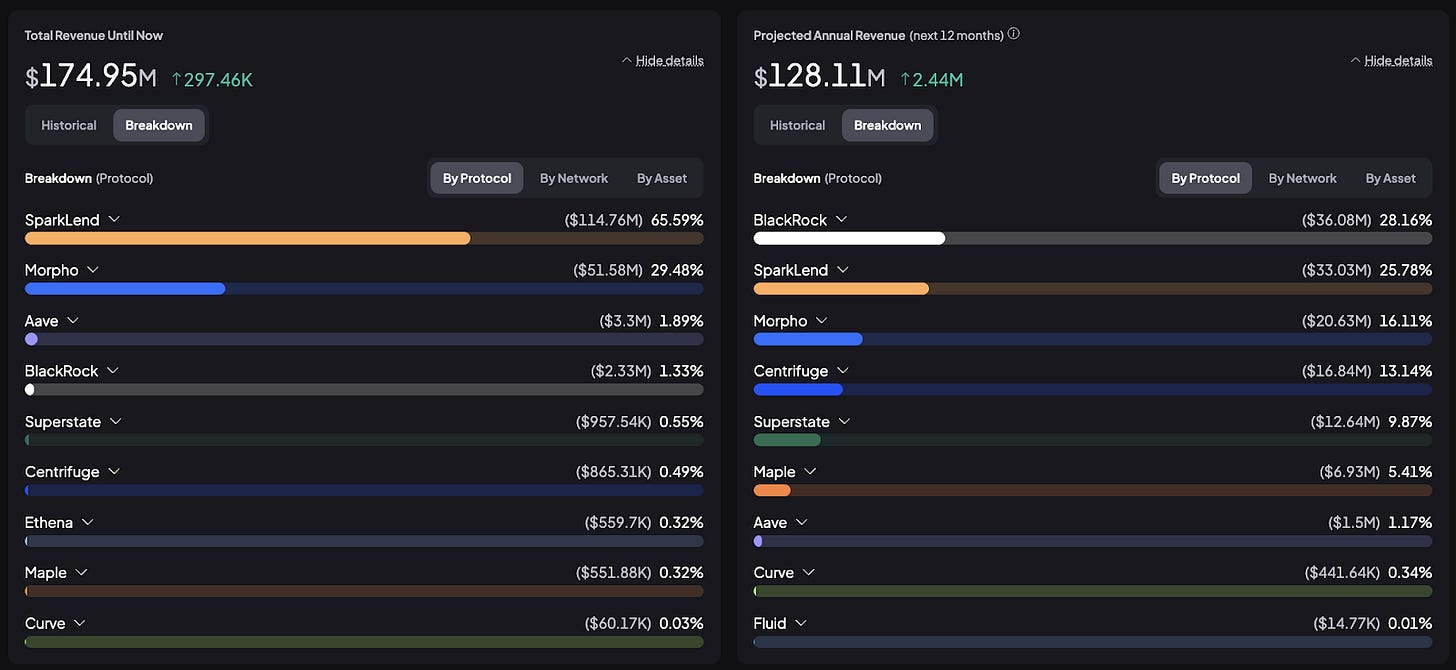

Further down the page is a section on revenue, showing two important charts: “Total Revenue Until Now” as well as “Projected Annual Revenue (Next 12 Months)”. It should be noted that the projected annual revenue metric is subject to market conditions and the APY of current asset allocations.

Both revenue widgets include a toggle that lets you break down each figure by protocol, network, or asset. For example, the “Total Revenue Until Now” breakdown shows that SparkLend allocations have generated the most revenue to date, while the breakdown of “Projected Annual Revenue (Next 12 Months)” reveals that the current BlackRock allocation is leading in projected revenue.

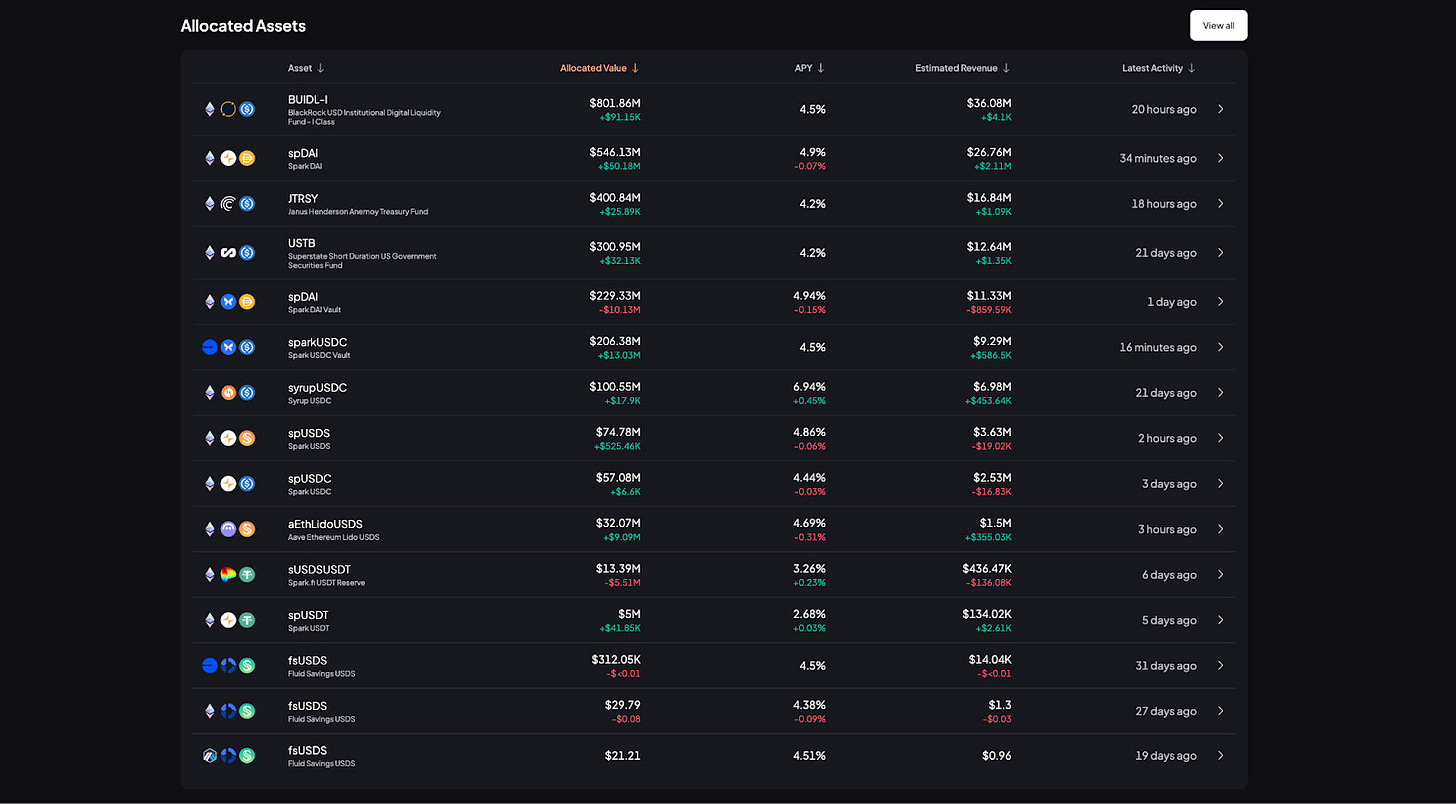

Allocated Assets

Further down the page, an “Allocated Assets” table lists each position with four key metrics: (i) Allocated Value, (ii) APY, (iii) Estimated Revenue, and (iv) Latest Activity.

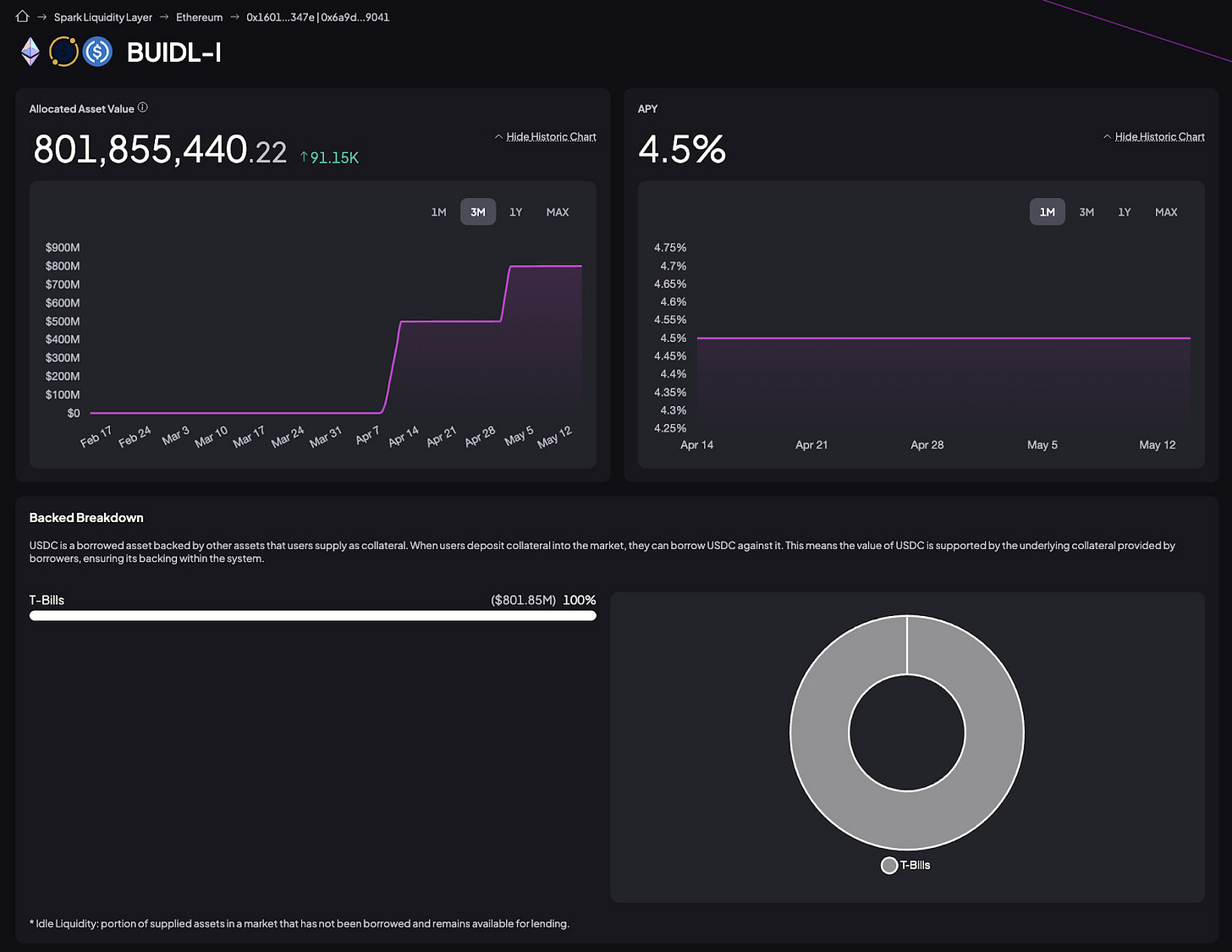

Selecting a row opens a dedicated page with additional information for that particular asset.

For example, selecting BUIDL-I opens a dedicated view that presents (i) allocated asset value, (ii) current APY, (iii) backing composition, (iv) cumulative revenue, (v) protocol and allocation information, and (vi) latest activity.

Allocation Activity

Finally, the bottom of the Spark Liquidity Layer page features an allocation activity tracker stream as well as a heatmap that highlights periods of increased activity. By clicking the “View All” button next to the “Latest Allocation Activity” section, the user can filter activity by network, protocol, and asset for more targeted search.

Savings Page

Total Assets in Savings

Spark Savings lets users deposit stablecoins into Savings Vaults (powered by Sky’s smart contracts) and receive Savings Tokens in return. As interest accrues, each Savings token rises in value relative to its underlying deposit asset. Spark currently supports three vaults: Savings USDS (sUSDS), Savings USDC (sUSDC), and Savings Dai (sDAI).

The Savings page in the Spark Data Hub presents both the total assets earning yield across the Sky Ecosystem, as well as deposits and APYs for each supported Savings Vault.

USDS Collateral Breakdown

To demonstrate that USDS always remains fully collateralised by a diversified portfolio of high-quality assets, the Spark Data Hub includes a dedicated collateral breakdown section. It draws on the same data as the Sky Risk & Analytics Dashboard, but organises the categories slightly differently. For example, T-Bills and cbBTC each appear as their own distinct category.

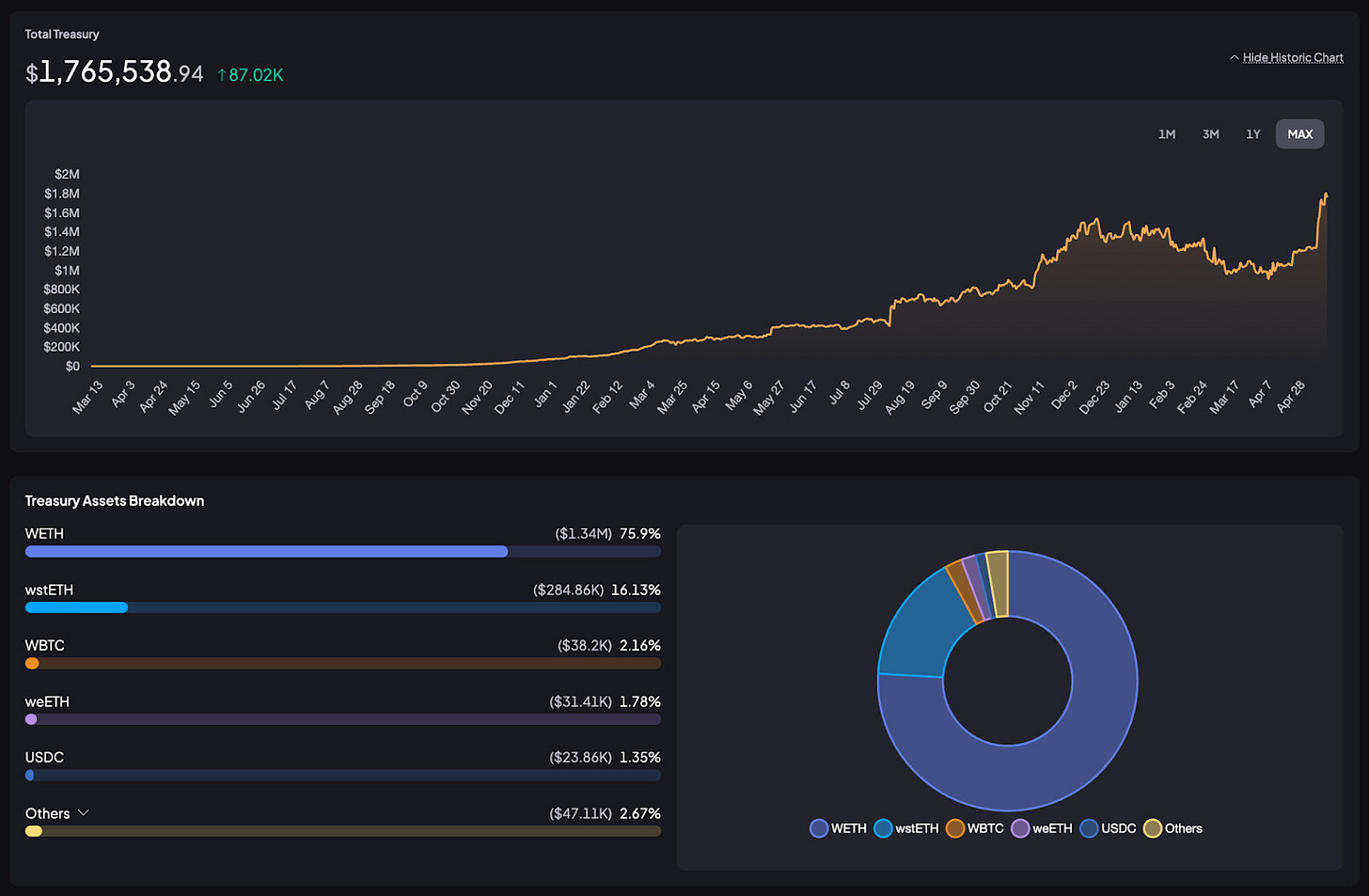

SparkLend Page

Total Value Locked

SparkLend is a decentralized, non-custodial liquidity market protocol based on the Aave v3 codebase. On the SparkLend page in the Spark Data Hub, total SparkLend TVL is included. Followed by separate widgets for the Ethereum Mainnet and Gnosis instances. Further down the page, a Treasury section presents the balances of the SparkLend Treasury.

For more SparkLend metrics, visit the SparkLend Dashboard.

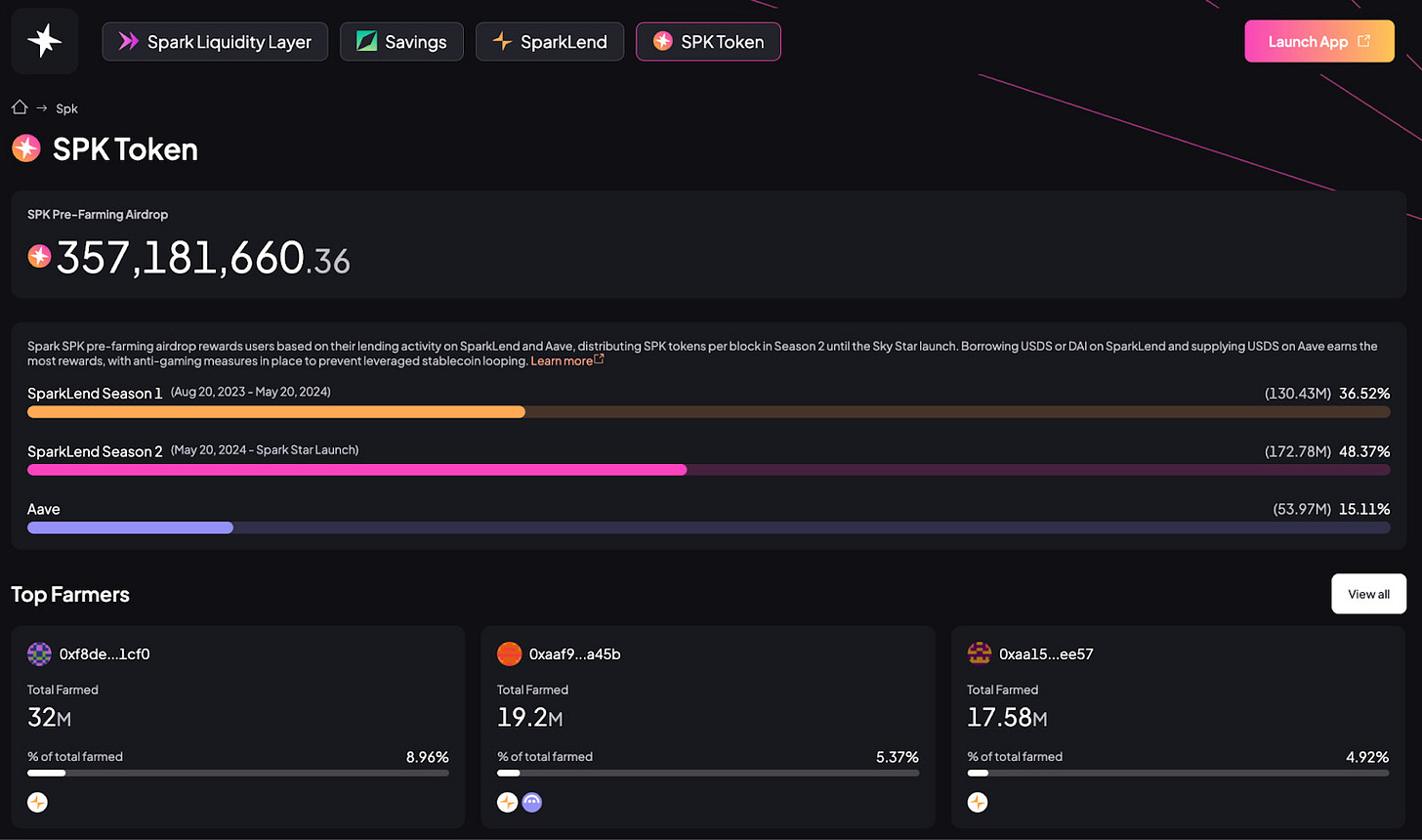

SPK Token Page

The Spark Star is the first Sky Star set to launch within the Sky Ecosystem. The Spark pre-farming airdrop campaign was first initiated in August 2023. The campaign’s first season concluded in May, 2024. The second season will run until the official launch of the Spark Star.

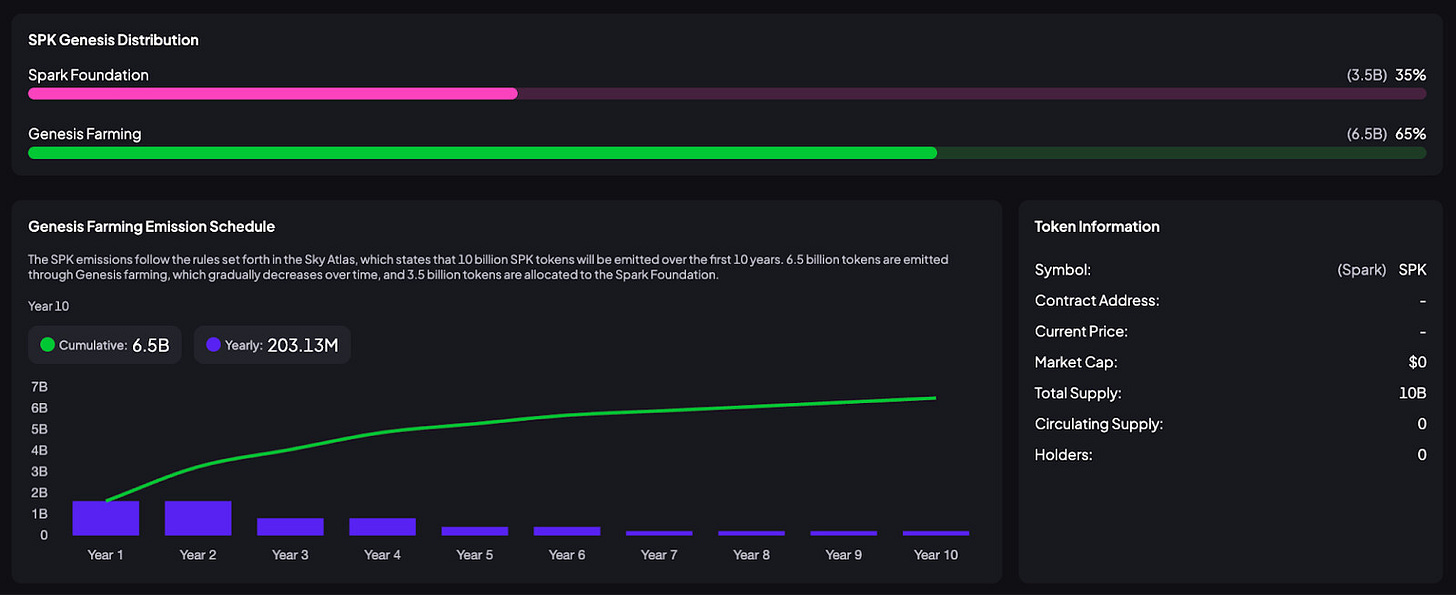

The SPK Token page in the Spark Data Hub includes relevant information regarding the pre-farming airdrop, top farmers, and the SPK genesis farming emission schedule.

Note that the SPK has not been launched and that no official launch date has been determined yet. Be cautious of scammers and fraudulent SPK tokens. Announcements regarding the token’s launch will be made from the official accounts of Sky and Spark.